Forward Capacity Auction (FCA)

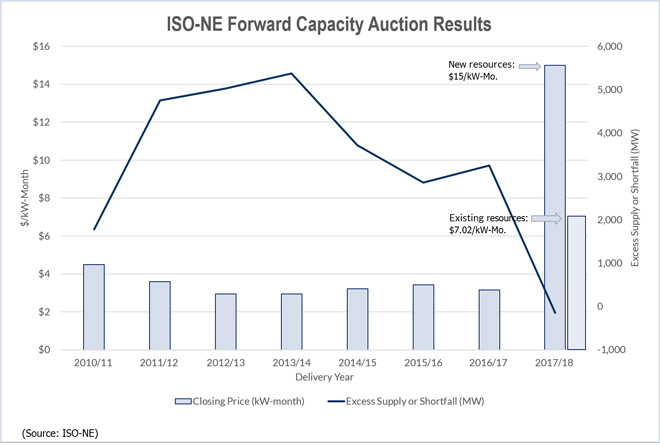

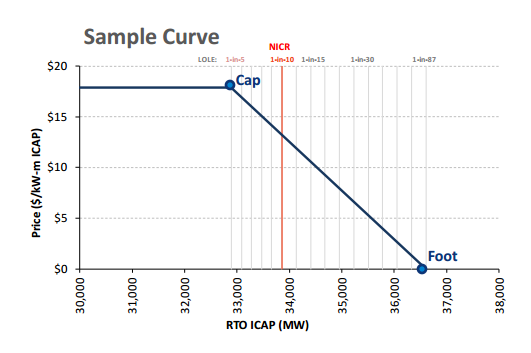

The 36% increase in prices in last week’s ISO-NE capacity auction likely represents the peak for the foreseeable future.

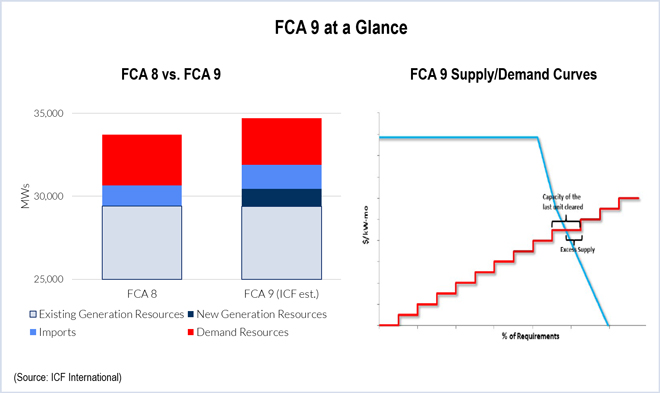

The ninth Forward Capacity Auction in ISO-NE saw prices increase by about one-third as 1,400 MW of new resources cleared to replace retiring coal plants.

FERC dismissed a challenge to the pricing rule for new generation in ISO-NE, which Exelon and Calpine had wanted tossed in advance of this week’s FCA.

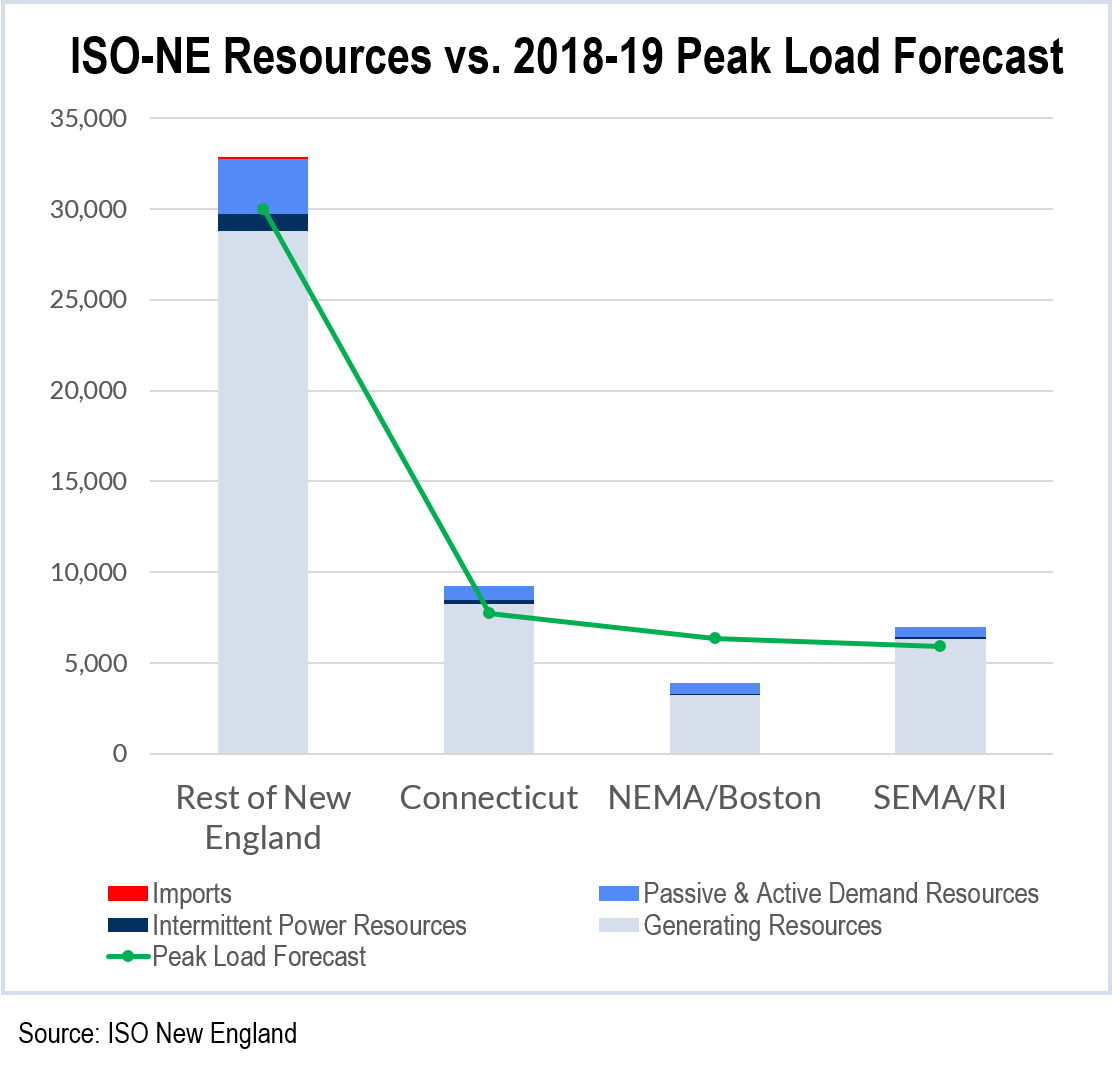

ISO-NE opened FCA 9 amid expectations of high prices as the region deals with plant retirements and tight natural gas supplies.

FERC approved rule changes allowing ISO-NE grid operators to fully integrate demand response into their wholesale markets.

FERC rejected a challenge by NESCOE to recalculate the contributions of DR and distributed resources in advance of ISO-NE FCA 9.

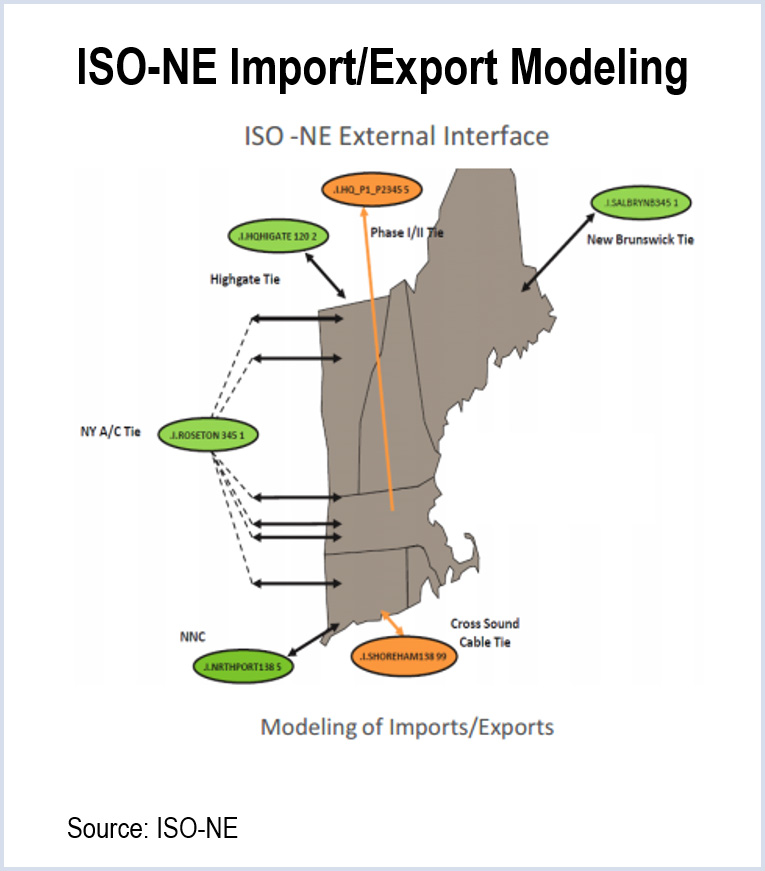

FERC last week accepted a plan by ISO-NE to increase its scrutiny of energy importers to mitigate market power in its capacity auctions.

ISO-NE has underestimated the impact of distributed generation and its pay-for-performance (PFP) program on the upcoming FCA 9, state officials told FERC.

ISO-NE generators, including NEPGA, asked FERC to change the New Entry Pricing Rule and the Peak Energy Rent Adjustment ahead of February’s FCA 9.

U.S. Solicitor General Donald Verrilli said he will ask the Supreme Court to review an appellate court ruling voiding the FERC’s authority over DR in wholesale energy markets.

Want more? Advanced Search