market power mitigation

FERC approved LS Power’s purchase of an 810-MW natural gas plant in central Pennsylvania despite some qualms from PJM’s Independent Market Monitor.

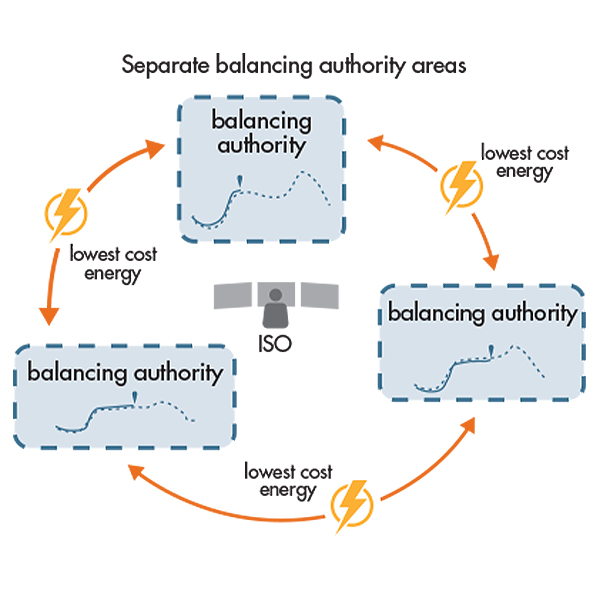

CAISO staff and stakeholders are looking to address an inconsistency in how the ISO tests for structural market competitiveness inside and outside of its balancing authority area in the Western Energy Imbalance Market.

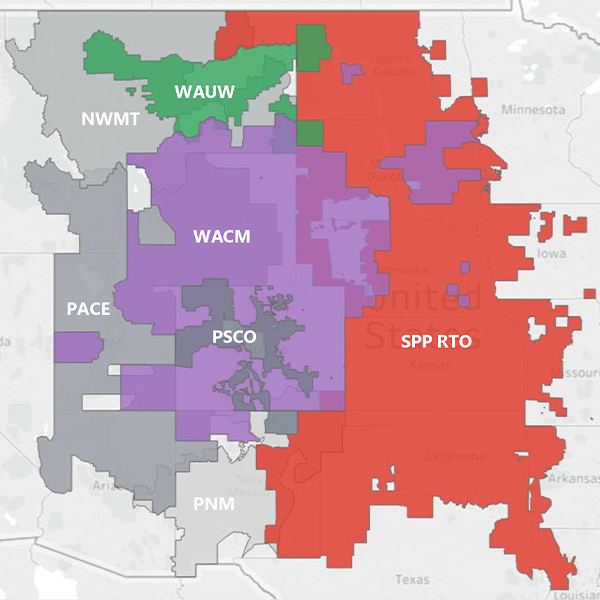

FERC rejected SPP’s proposed market power test for the Western Energy Imbalance Service, saying it gave the Market Monitor too much discretion.

FERC deferred making a decision on PJM’s proposal in response to a 2021 order directing the RTO to show cause as to why its rules regarding parameter-limited offers are just and reasonable.

Vistra says its acquisition of Energy Harbor and its nuclear plants will accelerate the company’s transformation and lead to a “re-segmentation” of its businesses when the deal closes.

FERC issued an order extending the time it has to review the proposed purchase of Energy Harbor by Vistra to next spring after several parties raised market concerns over the deal between two existing PJM generation owners.

PJM updated its Critical Issue Fast Path proposal, while several additional stakeholder presentations are scheduled for the remaining two meetings before they vote on packages.

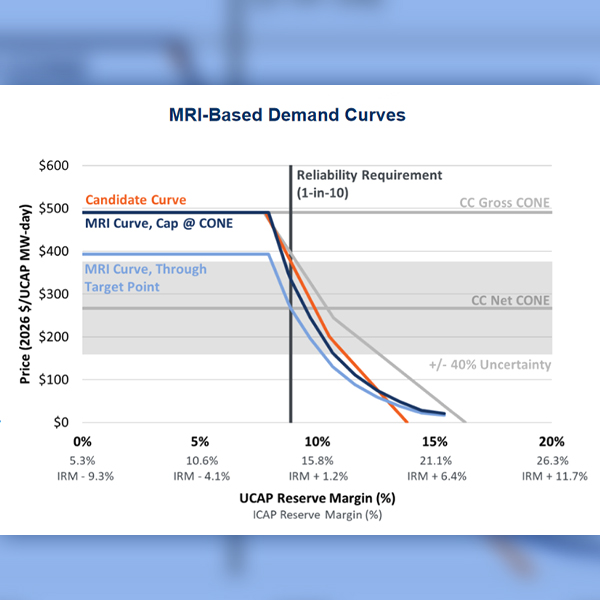

PJM completed its delivery of a sprawling presentation outlining its envisioned overhaul of the capacity market, followed by stakeholder presentations from Calpine, Daymark Energy Advisors and the East Kentucky Power Cooperative.

Vistra Energy's deal to buy Energy Harbor ran into opposition at FERC, where parties argued it would harm Ohio's retail market and further concentrate PJM's wholesale market.

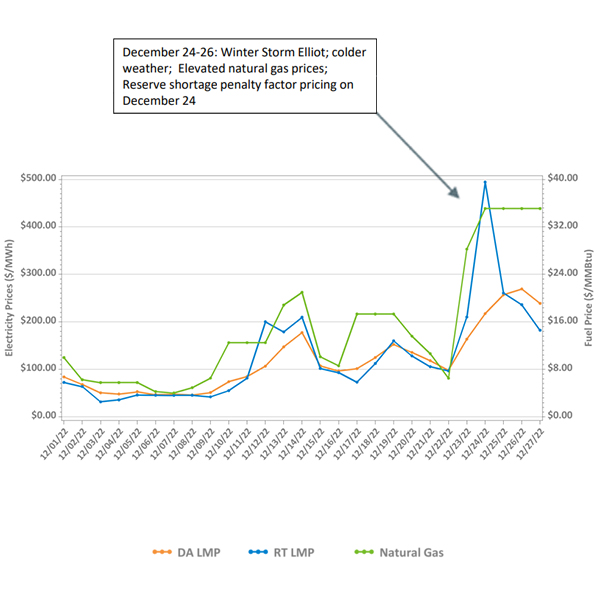

FERC ordered ISO-NE to reconsider its market mitigation rules because of an “unanticipated and highly atypical” situation that pushed prices higher Dec. 24.

Want more? Advanced Search