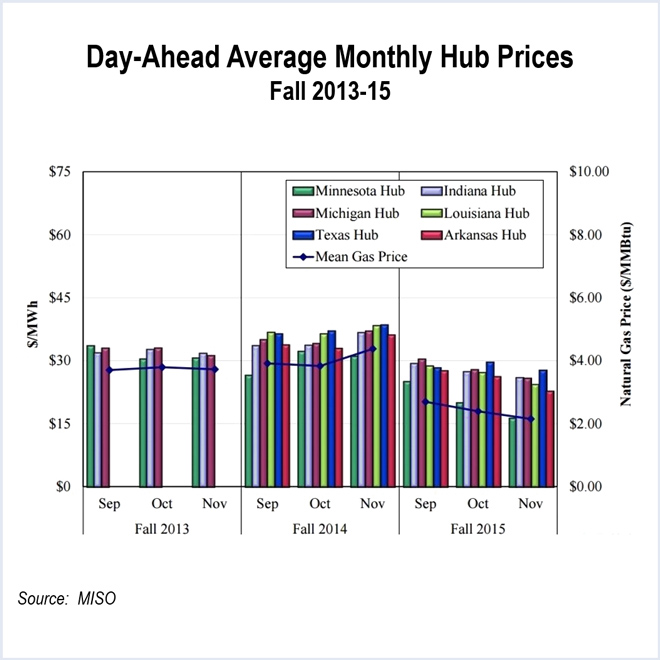

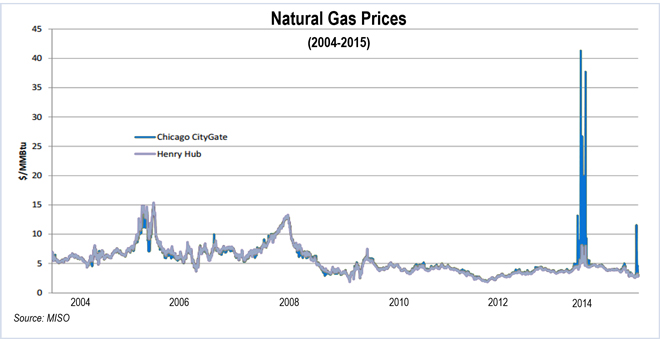

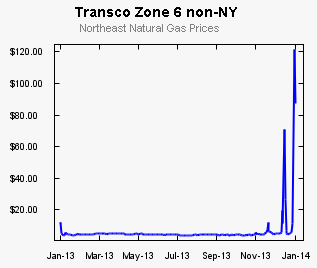

natural gas prices

NRG said that it may only need to continue operating one of the two units at the Huntley plant.

MISO Monitor David Patton reported that congestion caused by outages and under-scheduling of wind resources were causes for concern.

MISO said it may increase its energy market offer cap to $1,500/MWh this winter in response to expected FERC action.

ISO-NE will again rely on the winter reliability program it has used for the last two winters, which gives oil generators incentives to secure fuel at the beginning of the winter.

MISO is forecasting a 35% planning reserve margin for the winter and has implemented several changes to improve coordination with pipeline operators and ensure fuel deliveries to its fleet.

New York has adequate resources and improved operational practices to face the upcoming winter, a NYISO official told FERC.

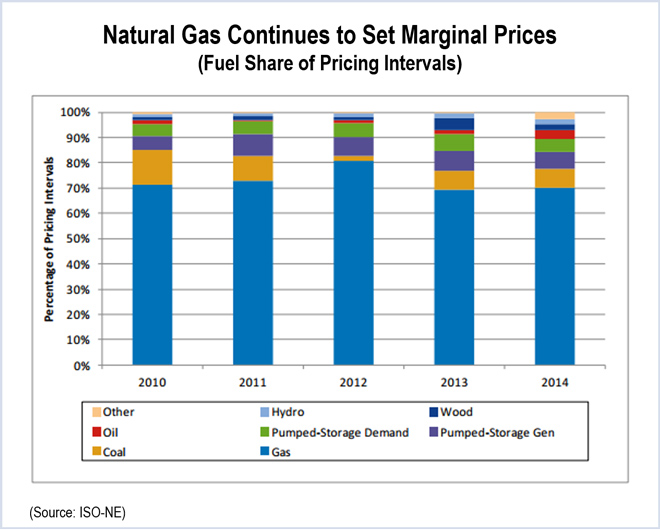

The ISO-NE Market Monitor said the increase was largely driven by higher fuel costs in the first quarter.

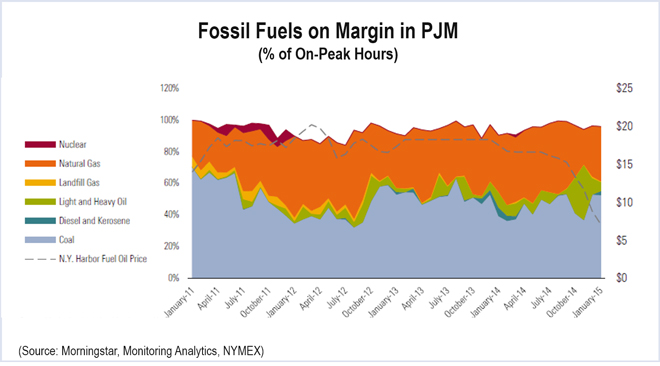

A new report by Morningstar predicts on-peak prices at PJM’s West Hub will result in “historically high” spark spreads in delivery year 2015-16.

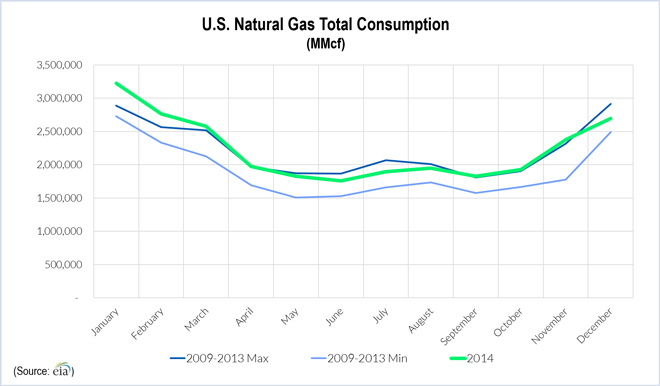

Natural gas demand and production both set records in 2014, while gas trading declined for the fourth straight year, FERC reported last week.

Stakeholders representing load may oppose efforts to change PJM’s $1,000 per MWh offer cap, despite a frigid winter in which high gas prices forced the RTO to obtain temporary waivers from the limit.

Want more? Advanced Search