Seattle City Light

PacifiCorp is poised to realize up to $359 million a year in net benefits from participating in CAISO’s EDAM, nearly double a previous estimate, according to a newly updated study by The Brattle Group.

The DOE awarded grants to nearly 300 projects at hydroelectric facilities to enhance dam safety, strengthen grid resilience and improve the environment.

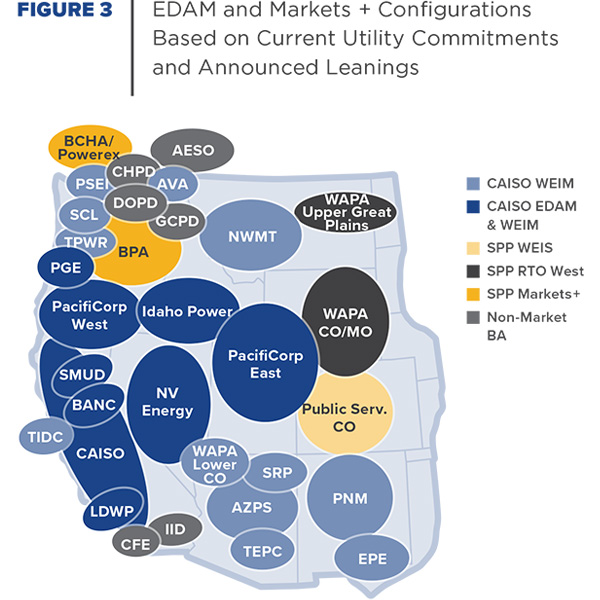

A new study commissioned by Renewable Northwest says Powerex is poised to benefit if the West ends up divided between CAISO’s EDAM and SPP’s Markets+.

CAISO’s Board of Governors and WEIM Governing Body unanimously voted to approve an expedited proposal to increase the ISO’s soft offer cap from $1,000/MWh to $2,000.

A key factor in the CAISO EDAM advantage is the benefits the utility would lose by leaving the Western Energy Imbalance Market, a Brattle Group consultant said.

The Bonneville Power Administration released a much anticipated staff report that tentatively recommends the agency choose SPP’s Markets+ over CAISO’s Extended Day-Ahead Market.

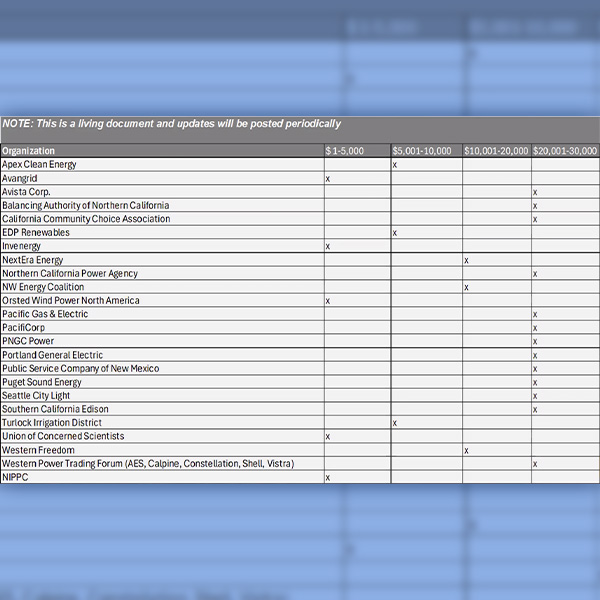

The West-Wide Governance Pathways Initiative has secured commitments of financial support from 24 utilities and other electricity-sector organizations and expects that list to grow.

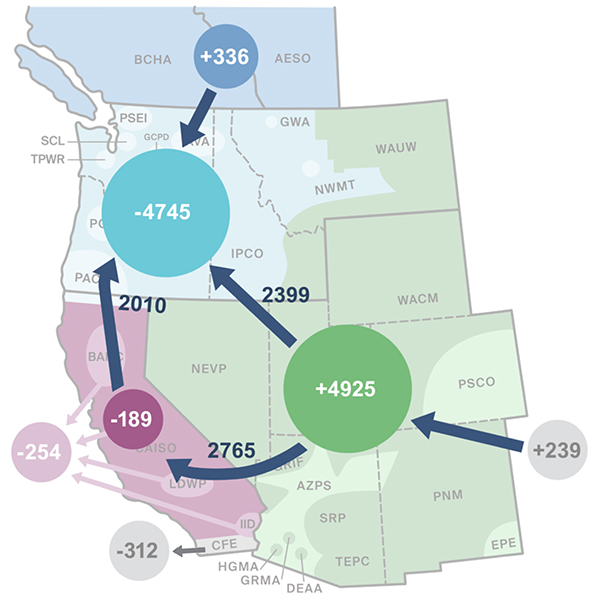

A new report from electricity marketer Powerex adds to the expanding debate around what transpired on the Western grid during a January cold snap that saw the Northwest forced to import large volumes of power.

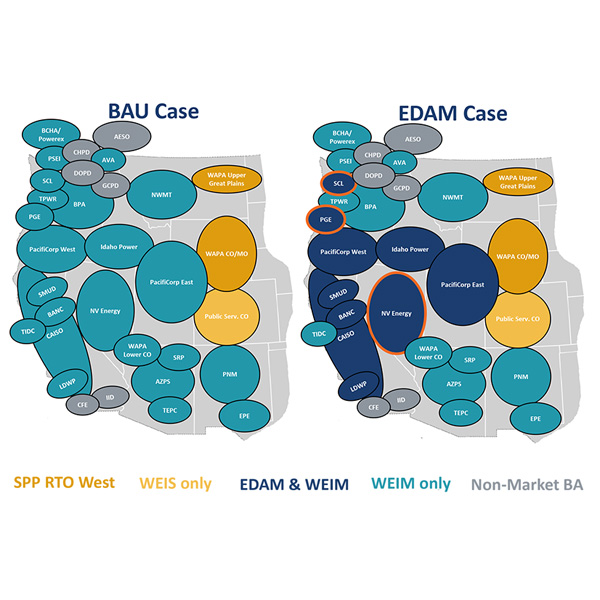

NV Energy would gain significantly more economic benefits from participating in CAISO’s EDAM than SPP’s Markets+, new analysis from the Brattle Group shows.

A dispute around the January cold snap that forced Northwest utilities to sharply increase electricity imports to meet surging demand has become a proxy for the broader day-ahead market contest between CAISO and SPP.

Want more? Advanced Search