transmission congestion

CAISO’s congestion revenue rights market showed unusual surpluses this summer because of higher congestion rents on Path 26.

The MISO market was competitive in 2017, but the RTO should do more to address increasing congestion and low capacity prices, Monitor David Patton said.

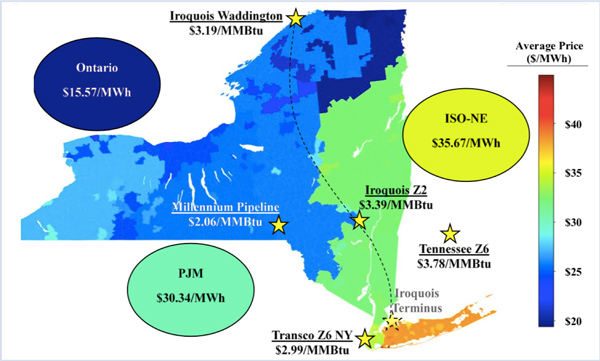

NYISO power prices averaged $35/MWh in April, up from $29.91/MWh in March and $31.06/MWh the same month a year ago.

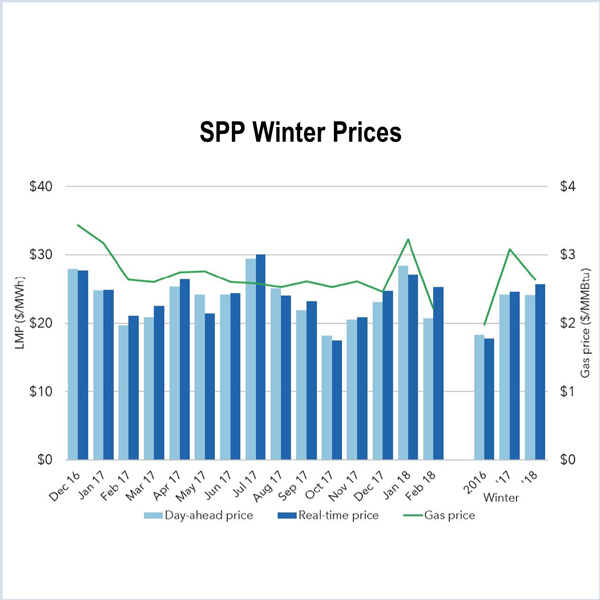

SPP’s winter real-time prices increased 4.6% from the previous year, according to the Market Monitoring Unit’s latest quarterly State of the Market report.

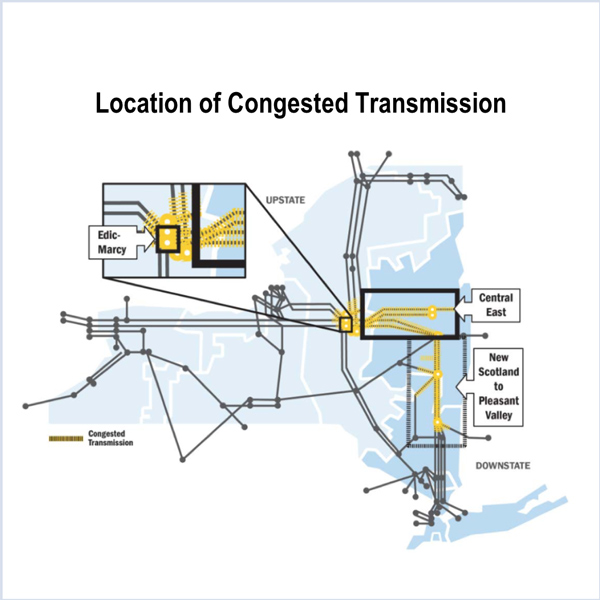

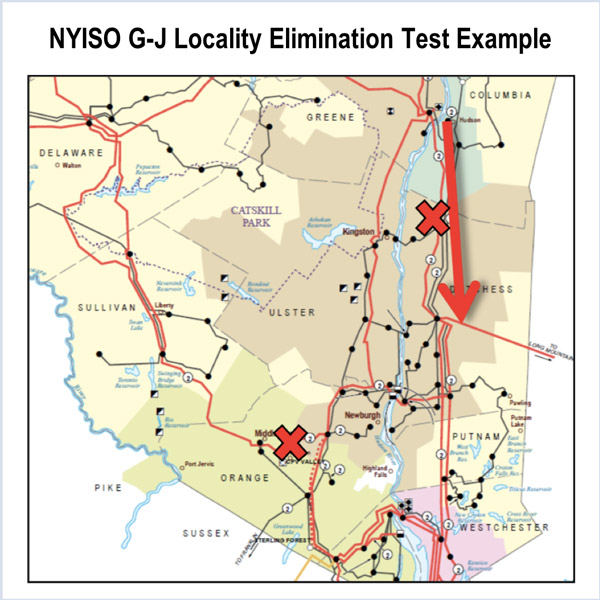

Preliminary results from a biennial NYISO study show high congestion in three areas of the New York bulk power system.

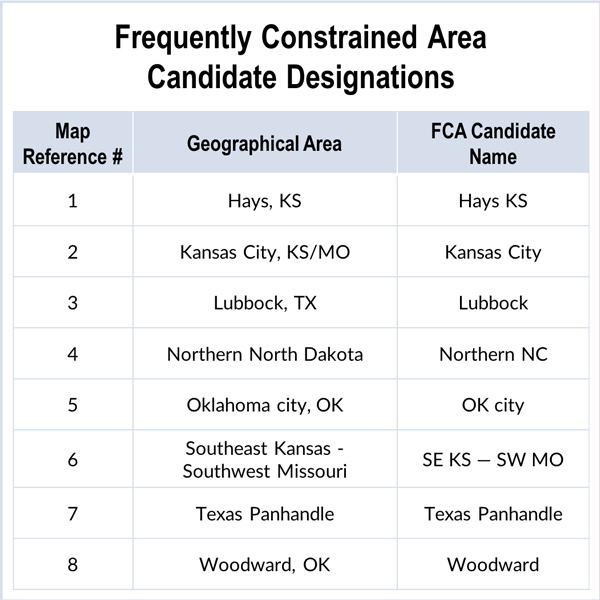

FERC accepted the recommendations of SPP’s Market Monitoring Unit to eliminate the Woodward frequently constrained area (FCA) in Northwest Oklahoma.

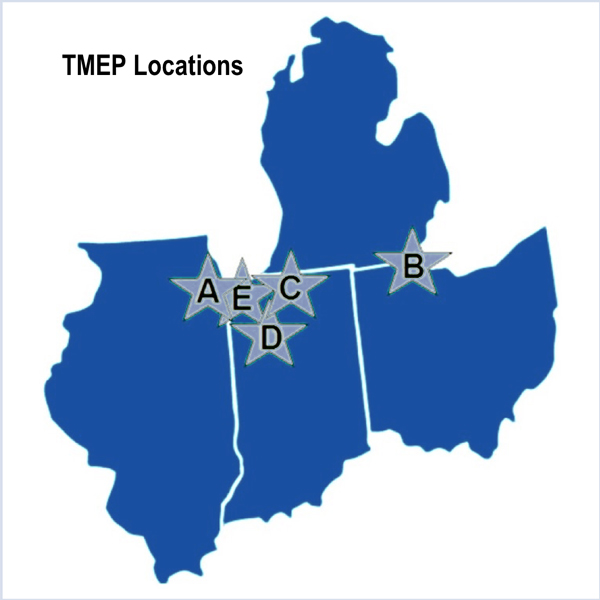

FERC rejected state and local regulators’ rehearing request over MISO’s plan to include its South region in cost sharing for its TMEPs with PJM.

NYISO’s Management Committee approved proposed rule revisions that would allocate day-ahead market congestion rent shortfalls and surpluses.

Stakeholders remain reticent to cede too much command and control to PJM, voting at the MRC meeting to defer a vote on revisions to Manual 14D.

CAISO is recommending cutting more than $2.7 billion from current transmission spending estimates across the 2027 planning horizon.

Want more? Advanced Search