Markets

When it comes to choosing between Western day-ahead market offerings, who else is participating in the market is a key consideration, a representative of a New Mexico utility said.

Western stakeholders expressed enthusiasm for the West-Wide Governance Pathway Initiative but called for more transparency in developing a regional market.

FERC remained dissatisfied with PJM’s and SPP’s FTR credit policies, while ending inquiries into those of CAISO, ISO-NE and NYISO.

PJM's Markets and Reliability Committee endorsed issue charges, opening stakeholder discussions on generator deactivation timelines and a potential overhaul of the reserve markets during its Sept. 20 meeting.

PJM members recommended various avenues for the RTO's Board of Managers to consider as it weighs a possible FERC filing incorporating components of proposals made during the critical issue fast path process.

FERC issued an order that J.P. Morgan Investment Management qualified as an affiliate of Mankato Companies and IIF US Holding 2, through which it is tied to other firms including El Paso Electric.

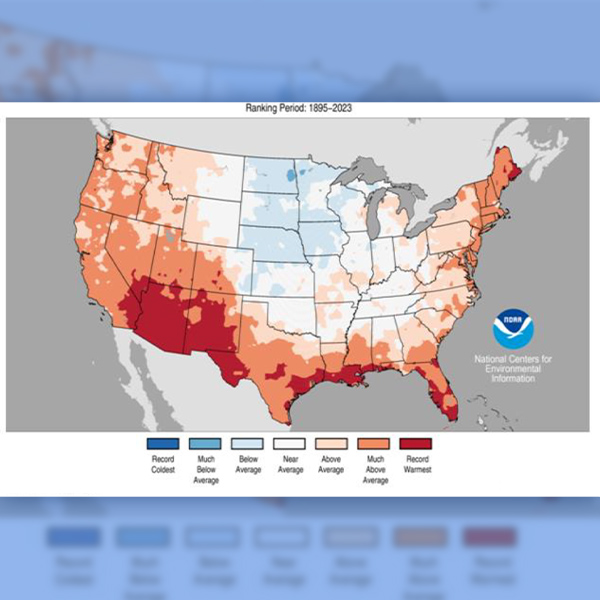

CAISO’s issuance of energy emergency watches and alerts in July came under conditions that mirrored those during California’s September 2022 heatwave.

The Idaho Public Utilities Commission last week said it will not join with other state regulators in an initiative to lay the groundwork for an independent RTO designed to serve the entire Western Interconnection.

NYISO secured Business Issues Committee approval of the ISO’s proposal to create separate capacity demand curves for summer and winter beginning with the 2025/2026 capability year.

PJM's Markets and Reliability Committee and Members Committee will convene Sept. 20, with endorsement of revised peak market activity rules and issue charges related to generator deactivation rules and reserve certainty on the agenda.

Want more? Advanced Search