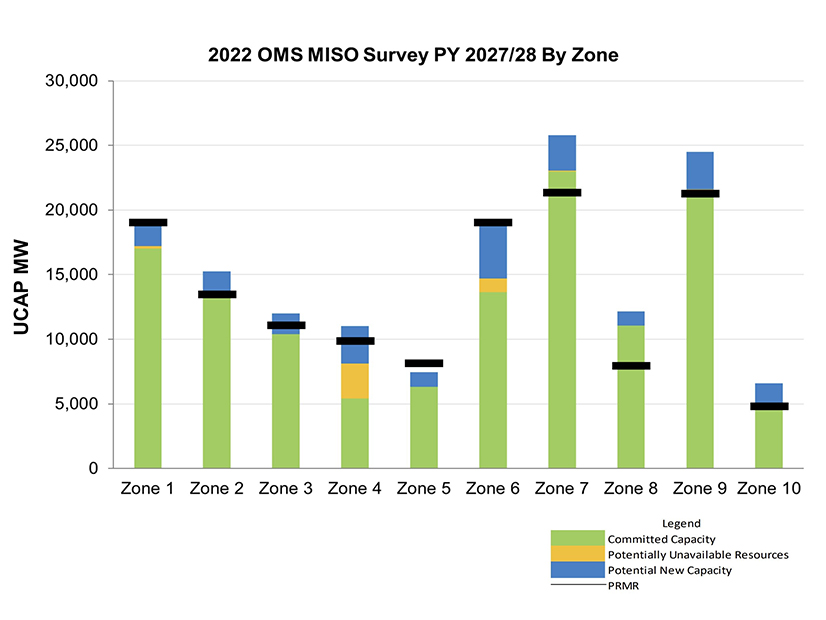

OMS-MISO RA Survey Says Supply Deficits Could Top 10 GW by 2027

Jun 10, 2022

MISO and the Organization of MISO States’ 2022 resource adequacy survey again sounded the supply alarm rung from the 2022/23 capacity auction results.