CAISO/WEIM

CAISO Board of GovernorsCalifornia Agencies & LegislatureCalifornia Air Resources Board (CARB)California Energy Commission (CEC)California LegislatureCalifornia Public Utilities Commission (CPUC)EDAMOther CAISO CommitteesWestern Energy Imbalance Market (WEIM)WEIM Governing Body

The California Independent System Operator serves about 80% of California's electricity demand, including the service areas of the state's three investor-owned utilities. It also operates the Western Energy Imbalance Market, an interstate real-time market covering territory that accounts for 80% of the load in the Western Interconnection.

CAISO released a set of guiding principles for upcoming discussions about seams between the ISO, SPP and other entities as the Extended Day-Ahead Market nears its opening in May.

FERC has rescinded the West-wide wholesale electricity price cap mechanism it implemented in response to widespread price manipulation during the Western energy crisis of 2000/01, saying development of new markets and expanded authority has led to improved monitoring capabilities.

Edison International earnings rose nearly 32% in 2025 despite the uncertainty swirling around its Southern California Edison subsidiary, which has been implicated in sparking the January 2025 Eaton Fire

California Public Utilities Commission President Alice Reynolds is leaving the CPUC and joining CAISO’s Board of Governors after more than four years at the helm of the state’s utility regulator.

Portland General Electric has agreed to buy most of PacifiCorp’s Washington utility operations for $1.9 billion.

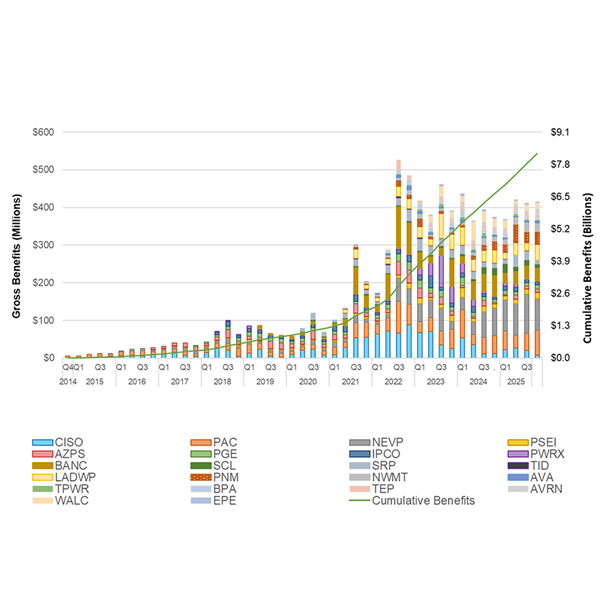

CAISO’s Western Energy Imbalance Market surpassed $8 billion in cumulative economic benefits since its 2014 launch after providing participants with $415.65 million in gross benefits in the fourth quarter of 2025, according to an ISO report.

The Regional Organization of Western Energy selected Western Freedom Executive Director Kathleen Staks as its interim president, while regulatory attorney Lisa Tormoen Hickey will assume the role of interim secretary.

Elliot Mainzer said working at BPA taught him two critical lessons that he's applied at CAISO: the importance of "robust stakeholder engagement" and "collaborative working relationships."

California continues to go all in on data center development, with Pacific Gas and Electric playing its role in the last quarter of 2025 by pushing gigawatts of projects through the investor-owned utility’s design and approval process.

California’s reliance on a large amount of imported electricity and fossil fuels is a potential weakness in the state’s energy security portfolio, a California Energy Commission staff report finds.

Want more? Advanced Search