As extreme winter weather descended on the Eastern U.S. and Canada, Hydro-Québec suspended power exports to ISO-NE on the New England Clean Energy Connect (NECEC) transmission line because of reliability concerns in Québec starting on the afternoon of Jan. 24.

The suspension continued throughout tight system conditions across the Northeast on Jan. 25 and 26.

“The polar vortex has brought extreme and sustained cold air across Québec,” Serge Abergel, chief operating officer for Hydro-Québec Energy Services, said in a statement. “The demand for power in Québec caused us to suspend deliveries over the New England Clean Energy Connect from Saturday afternoon until the present (with partial deliveries occurring between 1 p.m. and 3 p.m. on Sunday).”

He said Hydro-Québec expects deliveries to resume early Jan. 27, but he noted that “there could be yet further interruptions at peak hours over the next several days.”

According to ISO-NE data, NECEC deliveries dropped from about 1,100 MW to zero over a half-hour period midafternoon Jan. 24. Hydro-Québec sent power over the line for about two hours on the following day, sending up to about 600 MW before again cutting deliveries.

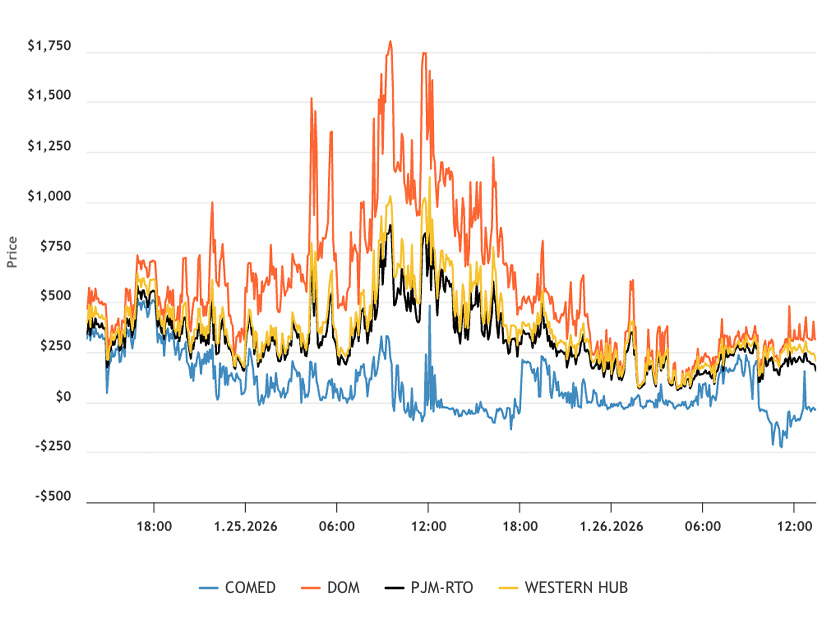

The loss of supply from the NECEC line appears to have significantly affected real-time energy prices: The ISO-NE real-time Hub LMP more than doubled during the 40-minute period NECEC cut supply Jan. 24, while the brief burst of supply Jan. 25 coincided with about a 33% decline in the hourly real-time LMP despite relatively steady demand.

Amid high prices in New England, ISO-NE has consistently been exporting power to Québec over the Phase 2 transmission line since the afternoon of Jan. 24, including about 830 MW during that day’s evening peak.

The NECEC line began commercial operations Jan. 16. (See NECEC Transmission Line Ready to Begin Commercial Operations.) The project includes supply contracts between Hydro-Québec and Massachusetts electric utilities requiring the company to send firm power to ISO-NE. The company does not have new capacity supply obligations associated with the line.

Hydro-Québec could face significant penalties for falling to meet the delivery requirements of the contracts. According to the power purchase agreement, supply interruptions that are not the result of a force majeure or a physical outage on the line can be cured by the additional deliveries within the same year or following year. Delivery shortfall during peak hours can only be cured during peak hours, and delivery shortfall in the winter can only be cured in the winter (D.P.U. 18-64, et al.).

“We are aware of the historic constraints on the Canadian grid due to the extreme cold,” said Maria Hardiman, a spokesperson from the Massachusetts Executive Office of Energy and Environmental Affairs.

“Hydro-Quebec is facing steep penalties for each day they are not providing power to Massachusetts, and we know they are working to resume power as quickly as possible,” Hardiman said. “Our contract ensures that ratepayers will still see lower-priced electricity, regardless of the power flowing over the line.”

Robert McCullough, principal of McCullough Research, said the suspension on the NECEC line appears to be a product of Hydro-Québec’s slim reserve margin for the current winter. According to the Northeast Power Coordinating Council’s 2025/26 winter reliability assessment, Québec had about a 1% reserve margin. Hydro-Québec’s peak load exceeded its 50/50 winter forecast by over 200 MW on Jan. 25.

McCullough attributed the slim reserve margin to “combination of bad weather, neighbors not able to help and insufficient maintenance on some of the dams.” NPCC’s report notes that Hydro-Québec’s available winter capacity was reduced by 5,594 MW because of maintenance and derates.

Abergel called the contention of insufficient maintenance “simply not accurate.”

In New England, ISO-NE peak load reached 20,182 MW on the evening of Jan. 25, slightly exceeding the region’s 90/10 winter forecast. Hourly Hub LMPs have reached as high as $777 $/MWh.

The RTO has avoided the need to take emergency actions throughout the weather event. It issued a precautionary alert on the morning of Jan. 25 and obtained a waiver from the U.S. Department of Energy allowing generators to override air permit limits to provide extra power.

Dan Dolan, president of the New England Power Generators Association, said the ISO-NE fleet “has performed exceptionally well this weekend using every different fuel and technology to maintain reliable, stable operations through arctic temperatures, heavy snowfall and even needing to send power to support our neighbors in Quebec.”

He highlighted the significant role oil generation has played in maintaining grid reliability. With gas generation limited because of high demand for heating, oil generation has consistently accounted for roughly a third of generation in the region since the suspension of deliveries on the NECEC line.

“Part of the diverse generation mix in New England is a large capability to use oil in periods of stress,” he said. “That has happened at a tremendous scale, which creates strain on fuel infrastructure. But the system is holding up through this first stretch.”

With more cold weather in the forecast over the next few days, “it is all hands on deck,” Dolan said.