PJM and the Independent Market Monitor are drafting proposals to rework the RTO’s reserve market.

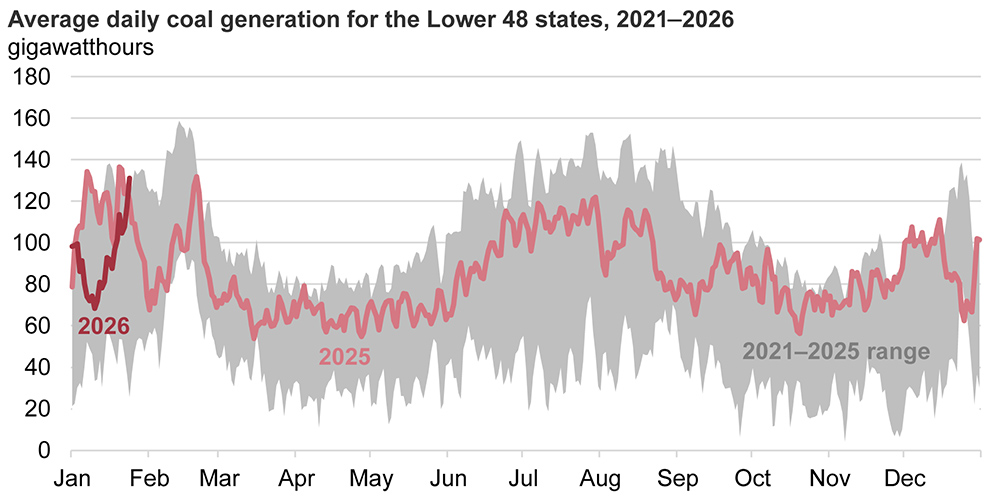

Reserve performance has been a focus since PJM implemented a market overhaul in 2022, which was followed by a drop in performance. That was counterbalanced with a 30% adder to the reserve requirement in May 2023, a change PJM’s Emily Barrett said has allowed the RTO to maintain adequate reserves at increased costs to load. The adder has recently been scaled back to 20% as average performance increased above 85%.

The RTO’s proposal would increase the penalties for synchronized reserves that fail to respond, replace primary reserves with a handful of more targeted products based on duration and how quickly the resource can respond, and shift procurement to nodal rather than sub-zonal. Barrett presented the package to the Reserve Certainty Senior Task Force (RCSTF) on Feb. 11.

The RCSTF’s work was one of several areas the PJM Board of Managers wrote is integral to the efforts to address rising data center load.

Barrett said the current penalty rate is based on the credits reserves received between events, which can result in widely varying penalty rates for resources in the same event. The logic driving the RTO’s proposal would instead use the amount paid to reserves between events. The rate would be set at the greater of:

-

- the mean synchronized reserve clearing price over the past delivery year, broken into intervals set at the average number of days between deployments exceeding 10 minutes (there was an average of 18 days between 10-minute synchronized reserve events in 2025, with an average clearing price of $1,910/MWh); or

- the maximum system marginal price in the 30 minutes after a resource underperformed.

Stakeholders said there has not been enough focus on why performance has been low, which should be addressed alongside discussions on how underperforming resources should be penalized. Untying the penalty rate from what a resource is paid, and setting it so high, could result in resources that receive a low or zero clearing price facing penalties in the thousands, they said. Resources could also be held responsible for PJM inaccurately modeling parameters.

Joel Romero Luna, a market analyst with the Independent Market Monitor, said it has been doing outreach since mid-2024 and found a lot of issues related to communications and personnel. Performance has improved since generation owners ironed those issues out, leaving inaccurate parameters as a primary driver of the low response rate. In particular, the ramp rate and economic maximum parameters tend to be based on averages rather than how a resource expects to respond.

Monitor Joe Bowring told RTO Insider resource performance had not dropped, but rather the response rate was low because of communications issues.

“There was no actual drop in performance, and PJM’s arbitrary increase in reserves was not justified and continues to be unsupported. The measured performance of some reserves was low because PJM was using antiquated communications technology. The technology issue has been significantly, but not completely, addressed,” he said.

Luna noted that the Monitor has recommended that PJM count overperformance when calculating the fleet response rate. When capturing both sides of reserve performance, he said the response rate is closer to 100%.

PJM’s Kevin Hatch added that while the outreach to the owners of underperforming resources has been led by the Monitor, RTO staff have been involved as well.

New Reserve Products

The RTO’s proposal would add a ramp/uncertainty reserves (RUR) product capable of responding in 10 minutes, which would come with its own reserve requirement, and an energy gap requirement met by a combination of reserves.

Barrett said primary reserves backfill needs not met by other products, but resources lack clear performance obligations and penalties for not meeting commitments.

The energy gap requirement would be tailored toward meeting operational needs identified on medium- and high-risk winter days, and the 30-minute secondary reserve requirement would serve as a backfill to ensure the largest system contingency is met.

The 30-minute RUR and 30-minute secondary reserve products both come with a four-hour minimum availability. Barrett said event duration is expected to become more important as battery storage becomes more common.

Vitol’s Jason Barker said the transparency of the new market design will be crucial to avoiding “black box pricing” with unexplainable variations in pricing.

IMM Proposal

The Monitor proposed to retain most of the reserve market structure, while changing the procurement requirements for 30-minute synchronized and primary reserves. Bowring said PJM should eliminate the adder on the grounds that it is not required for reliability and there is no demonstrated need for it.

The 30-minute reserve requirement would be defined as double the single largest contingency plus real-time uncertainty, defined as the two-hour forecast for wind, solar and load minus the forecasts used in real-time security-constrained economic dispatch 10 minutes in advance. The synchronized reserve requirement would be the single largest contingency plus the extended reserve requirement of 190 MW. The primary reserve requirement would be the larger of 150% of the largest contingency or real-time uncertainty.

Performance evaluation and penalties would remain the same for synchronized reserves. For non-synchronized reserves, they would be pegged to the evaluation and penalty rules for secondary reserves. Reserve resources would be required to be capable of operating for four hours or longer.

Bowring told RTO Insider the proposal would capture the uncertainty of wind and solar generation in the reserve requirement based on analysis of actual resource behavior. PJM has not shown there is a need for larger market design changes, he argued, and its proposal appears designed to increase energy market revenues while failing to fully reflect energy and ancillary market revenues in the capacity market.

“We do not believe that PJM has supported its proposals with analysis, and we do not agree that it’s appropriate to use the demand curve for reserves to increase energy market revenues,” he said. “PJM has not demonstrated the existence of an ‘energy gap’ despite multiple different approaches, and PJM has not demonstrated the need for making the reserve markets more complicated.”

Devendra Canchi, a senior analyst with the Monitor, said PJM’s proposal would go too far and increase costs with no corresponding benefit. He presented part of the Monitor’s proposal during the RCSTF’s meeting Jan. 28.

Some stakeholders argued that the Monitor’s position is not backed with analysis and PJM could save costs by modeling reserves in SCED and accounting for them in transmission constraints.

Bowring responded that the proposal is fully supported and that any nodal distribution scheme would be arbitrary.

“No one knows where the next generation trip or forecast error will occur. PJM’s proposal would increase market costs by arbitrarily redispatching expensive resources with no defined benefit,” Bowring told RTO Insider.

Deputy Monitor Catherine Tyler said adding constraints would increase ratepayer costs, and any assumptions PJM makes about when supply is going to be lost run the risk of being inaccurate. While it’s important to ensure that reserves are deliverable, PJM’s proposal would not accomplish that, she argued.