ERCOT says Texas’ 15 mobile generating units and a reliability-must-run unit all played an “important reliability function” during the Jan. 25-27 winter storm, the state’s first major cold-weather event since 2021’s disastrous Winter Storm Uri.

Grid operator staff told the Texas Public Utility Commission during its Jan. 29 open meeting that CPS Energy completed repairs to its Braunig Unit 3 before the storm arrived and that it was committed throughout the event.

Dan Woodfin, ERCOT’s vice president of system operations, told commissioners that Unit 3 provided “necessary support” to relieve overloads in the San Antonio region after a large unit in Central Texas tripped Jan. 25. The trip caused “brief exceedance” on the South Texas export constraint and post-contingency overloads on some transmission lines between the region and Houston, necessitating a localized transmission emergency declaration that lasted about 13 hours.

Woodfin said the grid operator also committed the mobile generating units that were moved from Houston to San Antonio in 2025 to provide reliability support for the South Texas constraint. The constraint was binding throughout the storm, he said.

“The combination of these actions was sufficient to operate the system reliably until the large unit came back on” Jan. 26, Woodfin said.

CPS had intended to retire the 55-year-old gas unit in 2025, but ERCOT determined that it was needed to address the South Texas constraint. The RMR is the grid operator’s first since 2016, when it entered into an agreement with NRG Texas Power over a previously mothballed gas unit near Houston. (See “Braunig Outage to End in December,” ERCOT: New Ancillary Service Key to Resource Adequacy.)

“Kudos to ERCOT and to everyone involved for how the grid played out during this storm,” PUC Chair Thomas Gleeson said. “I think everyone resoundingly said this was a success [in] probably the most difficult storm we’ve had to endure since Winter Storm Uri. Everyone should be commended for the work done on this.”

ERCOT navigated the storm without resorting to calls for conservation, issuing energy emergency alerts or suffering systemwide power outages. Demand peaked at nearly 76 GW on Jan. 26, far short of early projections of 83 GW. Staff said the state’s cloud cover and closures of businesses and schools helped reduce demand.

“In summary, ERCOT successfully managed the Texas electric grid through this cold-weather event. As always, we will continue to learn from this event to improve our tools and processes going forward,” Woodfin said.

FFSS Criteria Approved

The commissioners approved staff’s proposal establishing the criteria for participation in ERCOT’s Firm Fuel Supply Service (FFSS) program and the grid operator’s requirements to implement it, a result of a law passed during the 2021 legislative session in Uri’s aftermath (58434).

The rule codifies requirements to procure FFSS during natural gas curtailments and cold-weather events. Staff identified three categories of resources eligible to provide the service: on-site, resource-controlled and contractual off-site. The latter expands the program, although its budget remains unchanged at $54 million.

Jeff McDonald, the Independent Market Monitor’s director, objected to the inclusion of gas-fired resources but said he understood that the 2021 storm “precipitated a need on the reliability side.” He said he was more concerned that FFSS, other ancillary services and residential demand response are all out-of-market actions that affect the ERCOT energy-only market’s reliance on shortage pricing to incent investment.

“They suppress the shortage-pricing mechanism from being able to adequately signal that there’s shortages,” McDonald said. “Therefore, there’s less revenue in the market. Therefore, you’re going to have delayed or reduced new investment.

“I would like to see these programs be diminished over time and more focus placed on the kernel of resource adequacy for ERCOT, which is shortage pricing,” he added. “I do understand the need after Uri. Cracks were exposed that needed to be filled. Enough time has passed now that I think it’s time to … focus more on in-market price signaling to provide reliability services to fill those cracks.”

Gleeson said he agreed with McDonald about the need to allow the market to provide revenues from scarcity, but he also said the rule makes sense “where we sit right now.”

“I think what you’ll see is continued discussion about that and the right timing to actually implement those changes,” Gleeson said.

Batch Zero’s Phased Study

ERCOT will conduct its first “batch” study of large load interconnection requests in two phases, Jeff Billo, vice president of interconnection and grid analysis, told the PUC.

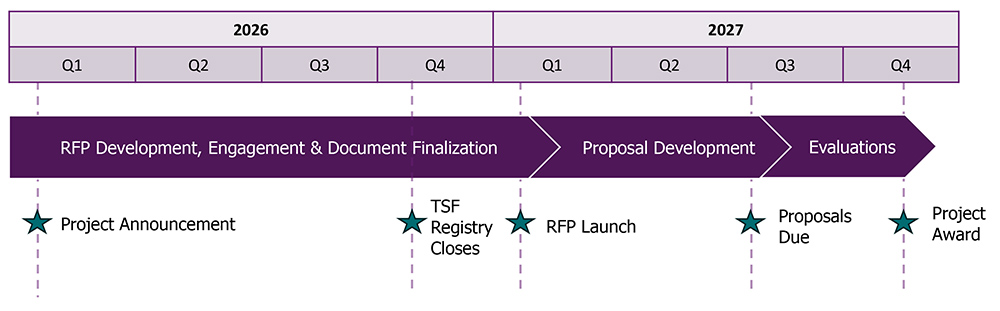

The grid operator has already proposed a “Batch Zero” process to address the 232 GW of interconnection requests from AI facilities, cryptocurrency miners and other large loads. Now, that batch’s first phase, or Phase A, will be limited to large loads that want to be energized early in 2027. Projects in that batch will undergo an abbreviated version of the Batch Zero study. (See ERCOT Again Revising Large Load Interconnection Process.)

A longer, full Phase B study will be for projects with longer timelines. It would begin in August and be completed early in 2027. Even then, the loads will have to pass ERCOT’s quarterly stability assessment five to eight months before they are energized.

“We need to do an operational assessment before those loads connect … to see if there’s anything that has changed since the studies were performed and see if we need to implement any sort of operational constraints to make sure that we know where the constraints are on the system,” Billo said.

The Batch Zero study will serve as a foundation for the other batch studies that follow every six months, beginning in the first quarter of 2027, Billo said. ERCOT will share the draft criteria for large load requests during a Feb. 3 workshop.

Responding to Federal Issues

Staff told commissioners that the PUC has joined the ballot pool for NERC’s Long-Term Planning Energy Assurance project (2024-02), allowing it to participate in future votes and comment windows (54987).

NERC has scheduled a workshop and meetings Feb. 17-19 to discuss concerns and start drafting revisions to the proposed standard, which has drawn pushback from utilities over a requirement to create corrective action plans. The standard failed to pass a first round of voting, garnering only 17.8% support.

PUC staff plan to return to the commission with comments to file in the proceeding.

“I think that’s the right course of action. I think corrective action plans seem out of scope for” NERC, Gleeson said.

The PUC has already adopted a reliability standard that sets criteria for frequency, duration and magnitude of loss-of-load events. (See Texas PUC Sets Reliability Standard for ERCOT.)

Following a closed session, the PUC voted to file amicus briefs supporting FERC in two dockets before the D.C. Circuit Court of Appeals: Clean Wisconsin, the Natural Resources Defense Council and the Sierra Club’s appeal of the commission’s approval of MISO’s Expedited Resource Addition Study process (25-1264), and Advanced Energy United, Advanced Power Alliance, American Clean Power Association and Solar Energy Industries Association’s challenge to SPP’s Expedited Resource Adequacy Study (25-1265).