Officials from members of the Northeast States Collaborative on Interregional Transmission expounded on the group’s strategic action plan, released in April.

“There are certain basic truths that apply to transmission planning and development today,” Katie Dykes, commissioner of the Connecticut Department of Energy and Environmental Protection, said to an audience of 300 people during a teleconference April 29.

She said the collaborative’s nine states — Connecticut, Delaware, Maine, Maryland, Massachusetts, New Jersey, New York, Rhode Island and Vermont — saw a benefit to working together to ease the complications of transmission development as much as possible. “It’s imperative that we do so, and we’ve certainly made a lot of progress over the past two years.”

Dykes said numerous studies found that interregional transmission connections could help stabilize the grid and drive down energy costs. With tariffs and long-term supply chain uncertainties looming, it’s important that states work together to ease the barriers to interregional transmission development.

“To achieve this, we need to agree on common standards for transmission technologies so that investments across the system are compatible and consistent,” said Dykes, citing the example of an HVDC multi-terminal platform for offshore wind. “Such standardization could lead to more certainty in the supply chain and reduce costs for ratepayers.”

The plan, released by the Brattle Group, recommended the states work with the three grid operators in the Northeast to find interregional “low-hanging fruit” that could be developed. (See Plan Lays out Steps for State-led Interregional Transmission in Northeast.)

“PJM continues to support working with our neighbors on interregional planning,” PJM spokesperson Jeff Shields said in response to RTO Insider.

“Transmission planning is an integral part of planning the future power system, as is working collaboratively with the New England states and neighboring regions,” ISO-NE spokesperson Randy Burlingame said. He cited ISO-NE’s Interregional Planning Stakeholder Advisory Committee and a recent request for proposals on interregional transmission. “We look forward to continued collaboration with the states and our counterparts to ensure a reliable grid today and in the future.” (See ISO-NE Releases Longer-term Transmission Planning RFP.)

NYISO declined to comment.

“No process currently exists for a group of states spanning different transmission planning regions to take the steps necessary to identify, evaluate and ultimately agree to share the cost of beneficial interregional transmission projects,” said Joe DeLosa III, a manager and consultant for Brattle.

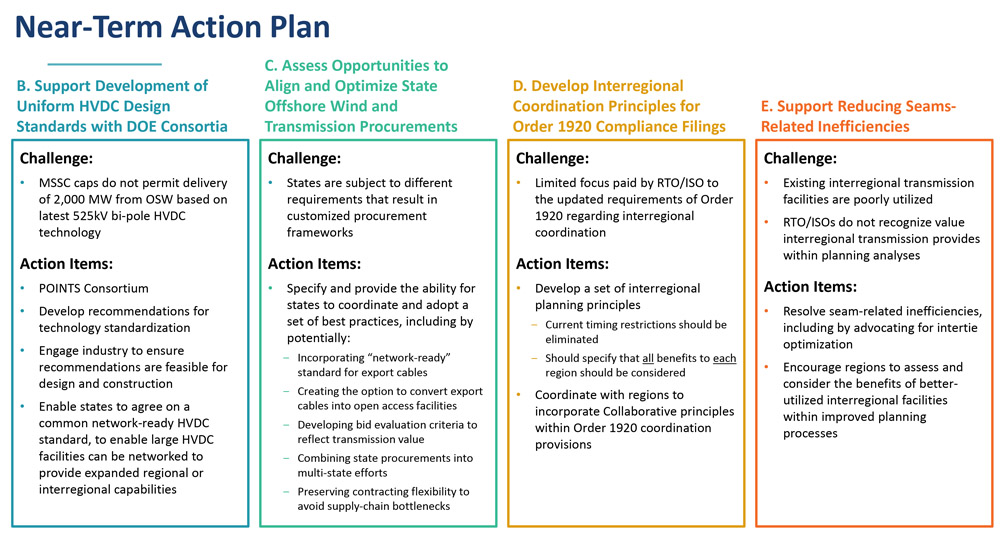

He presented more specifics on the action items outlined by the plan. In the near term, these include working to standardize transmission technology to permit the delivery of 2,000 MW from offshore wind on 525-kV lines, harmonizing state regulations and procurements, and directing the grid operators to implement interregional planning principals in line with FERC Order 1920. They also include reevaluating the benefits that could be provided by the extant interregional connections.

Over the next few years, the states would expand their efforts via mid-term action items, including reevaluating whether tariffs need updating for interregional transmission and exploring the formation of a buying pool for transmission equipment.

A panel of state officials including John Bernecker, director of the Transmission Center of Excellence at the New York State Energy Research and Development Authority; Kira Lawrence, senior policy adviser for the New Jersey Board of Public Utilities; and Jason Marshall, deputy secretary and special counsel in the Massachusetts Executive Office of Energy and Environmental Affairs, addressed questions from the audience. The panel was moderated by Suzanne Glatz, a consultant and former director of interregional planning for PJM.

“One of the critical activities is breaking down silos that have existed within transmission planning, both across the regions but really, across the ways that the benefits of transmission have been assessed,” Bernecker said. He said transmission typically has been assessed for market efficiency, reliability or for public policy. “In reality, a given transmission project will have benefits across different areas.”

The panel was asked why the plan seemed to have a specific focus on offshore wind given the opposition from the Trump administration.

“While wind power is mentioned, that’s more from the perspective of specific technical barriers that need to be addressed in order to fully integrate those resources in the long term,” Bernecker said. “But that’s not the focus of the plan in its entirety.”