By William Opalka

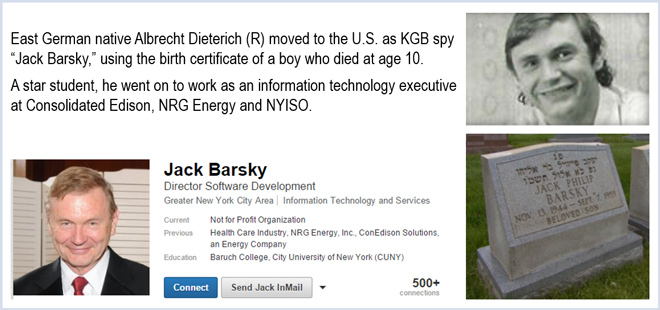

A former Soviet spy who lived in the United States for more than 35 years under an assumed identity has been working since 2011 as director of software development for NYISO but never had access to any sensitive data or operations, officials said.

The power grid operator responded to a CBS “60 Minutes” report that aired Sunday, in which “Jack Barsky” revealed his Cold War past, when he posed as an American in the 1970s and 80s in the hopes of gaining access to high ranking government officials.

Born Albrecht Dieterich in East Germany, he was recruited by the KGB as a student. He assumed the identity of Jack Barsky after Soviet agents provided him the birth certificate of an American boy who died at age 10.

Barsky told CBS he was directed to infiltrate the office of Zbigniew Brzezinski, President Jimmy Carter’s national security adviser from 1977-1981 but never got close to the official. He said his biggest coup was providing Soviets enterprise software designed by an insurance company for which he worked.

Barsky, who lives northeast of NYISO headquarters in Rensselaer, was placed on administrative leave recently when he told the ISO he was going to be the subject of a “60 Minutes” report.

According to his LinkedIn profile, Barsky came to NYISO after serving as chief information officer for NRG Energy from 2006 to 2010 and ConEdison Solutions from 2002 to 2006. The companies confirmed his employment to Capital New York.

“According to the story on ‘60 Minutes,’ Mr. Barsky appears to have had regular contact with the FBI over a period of many years that was not publicly disclosed. The FBI generally informs a company such as the NYISO of any potential cyber security threat of which it is aware. We have a long standing and productive relationship with the FBI and at no time did the FBI indicate that this employee posed a threat,” NYISO spokesman David C. Flanagan said.

“Out of an abundance of caution, we have conducted internal forensic reviews of physical and computer records and have not discovered any security threats or any indication that the employee engaged in improper behavior. The employee did not have direct access to grid operations or energy market systems that would enable manipulation of software. Further, the individual did not have physical access to our control rooms.”

Flanagan said NYISO has hired an outside firm to “to conduct a separate analysis to confirm our findings.”

Flanagan would not say if the recent departures of two NYISO executives — Jennifer Chatt, vice president for human resources, and Tom Rumsey, senior vice president of external affairs — were related to the Barsky revelation. Rumsey’s departure came just weeks after he received a promotion announced in January. (See NYISO CEO Stephen Whitley to Retire in 2016; Dewey, Rumsey Promoted.)

According to the “60 Minutes” report, Barsky was discovered in 1997 by the FBI, when he was working as a computer programmer in New Jersey. His last name had appeared in materials provided to the government by a KGB defector in 1992.

Barsky was never arrested or charged, as the FBI determined he would be of no value in jail; he was more useful living freely as he was debriefed about KGB operations.

Barsky had been ordered back to Germany in 1988 when the Soviets told him his cover had been blown, but he refused out of devotion to his American child. Under the threat of death, Barsky told “60 Minutes,” he concocted a story that he was suffering from AIDS and could only be treated in the U.S. The Soviets left him alone and he continued to live and work undetected.

Barsky, 70, told the Albany Times-Union that he is writing a book about his life.