The contentious $1,000/MWh energy offer cap is likely to be the subject of some of the most vigorous debate at Thursday’s Markets and Reliability and Members committees meetings.

The MRC deadlocked over the issue Sept. 18 with none of three proposals to lift the cap winning a two-thirds majority. (See Members Deadlock on Change to $1,000 Offer Cap.)

An Oct. 10 task force meeting failed to bridge the gap between generators and load interests. As a result, PJM will ask the MRC to sunset the task force. (MRC agenda item # 3.)

Meanwhile, despite the lack of consensus, Bob O’Connell of J.P. Morgan Ventures Energy will attempt to win MC approval to effectively eliminate the cap from the Operating Agreement as of June 1, 2015. (MC agenda item #4.)

O’Connell’s proposal also suggests that cost-based offers below $2,250/MWh – equivalent to a 15,000 Btu/kWh generator burning gas purchased at $150/Btu -– be allowed to set LMPs. Cost-based offers above $2,250 would be reimbursed through uplift and not set the clearing price. Price-based offers would be permitted to equal cost-based offers when the latter is more than $1,000/MWh.

At the April MRC meeting, O’Connell said that if stakeholders refused to approve a problem statement considering changes to the cap, as few as five members could create a user group to push for the change “through an alternative stakeholder process that may disenfranchise certain members.” (See Effort to Lift Offer Cap Advances After Debate.)

Below is a summary of the other issues scheduled to be brought to a vote at the MRC and MC meetings. Each item is listed by agenda number, description and projected time of discussion, followed by a summary of the issue and links to prior coverage in RTO Insider.

RTO Insider will be in Wilmington covering the discussions and votes. See next Tuesday’s newsletter for a full report.

Markets and Reliability Committee

2. PJM Manuals (9:10-9:30)

Members will be asked to endorse the following manual changes:

- Revisions to Manual 11: Energy & Ancillary Services Market Operations and Manual 28: Operating Agreement Accounting that will set the default Tier 1 synchronized reserves estimates to zero MW for nuclear, wind, solar, batteries and hydro generators. The change means those resources will not receive compensation unless they actually produce during a spinning event.

- Changes to Manual 1 to comply with a revised reliability standard given preliminary approval by the Federal Energy Regulatory Commission last month. COM-002-4 (Operating Personnel Communications Protocols) requires the use of a three-part communications process when issuing operating instructions. (See FERC Backs NERC, NAESB Standards.)

- Revisions to Manual 14A: Generation and Transmission Interconnection Process that create a pre-application process for new and existing generation resource additions of 20 MW or less in compliance with FERC Order 792. Potential interconnection customers will have to submit a formal written request and a $300 processing fee. PJM is requesting these changes be effective beginning Nov. 1. (See PC Starts Work on Small Generator Interconnection Changes.)

- Revisions to Manual 19: Load Forecasting and Analysis clarifying process for adjusting load forecasts due to significant load changes. The changes, which do not reflect any change in the procedures, were endorsed by the Planning Committee Sept. 2.

- Conforming changes to Manual 18: PJM Capacity Market in response to members’ requests for details of the process for requesting and cancelling demand response maintenance outages and a FERC order allowing Annual, Extended and Limited products for DR (ER11-2288). The changes detail what qualifies for the maintenance outage, timeframes for the notification window, length of outage, extensions, cancellations, impacts to compliance calculations and resource testing.

3. Cap Review Senior Task Force (CRSTF) (9:30-9:50)

The committee will be asked to approve sunsetting the task force. (See above.)

4. Energy / Reserve Pricing & Interchange Volatility update (9:50-10:20)

Members will vote on whether to approve new rules to reduce uplift and ensure energy prices better reflect operator actions. The changes would increase synchronized and primary reserve requirements under emergency conditions when additional intraday resources are scheduled. The committee also will be asked to approve limits on interchange during emergency conditions. The limit would be used when operators have made firm resource commitments and anticipated interchange schedules are sufficient to meet projected load for the hour. The changes were approved last month by the Market Implementation Committee. (See MIC Briefs.)

5. Transmission Owner (TO) Data Feed (10:20-10:30)

Members will be asked to approve Operating Agreement and manual changes to make it easier for transmission owners to access real-time generator data. The changes are intended to improve situational awareness and emergency response. The Operating Agreement would be revised to include a universal non-disclosure agreement, eliminating the need for a separate data confidentiality agreement. Transmission owners will be able to obtain data from generators in their zone without justification. For generators outside its zone, the TO must confirm that the plant is in the current TO energy management system (EMS) model or will be included in an expanded model. The changes were approved by the Operating Committee last month.

6. Cold Weather Resource Improvement (10:30-10:45)

Members will be asked to approve rules for voluntary winter testing of seldom-used generators. The tests would be limited to generators that haven’t run in the prior eight weeks and days when temperatures are below 35 degrees Fahrenheit. (See Winter Testing Could Cost $15.9M.) The Operating Committee approved the changes earlier this month.

7. 2014 IRM STUDY RESULTS (10:45-11:00)

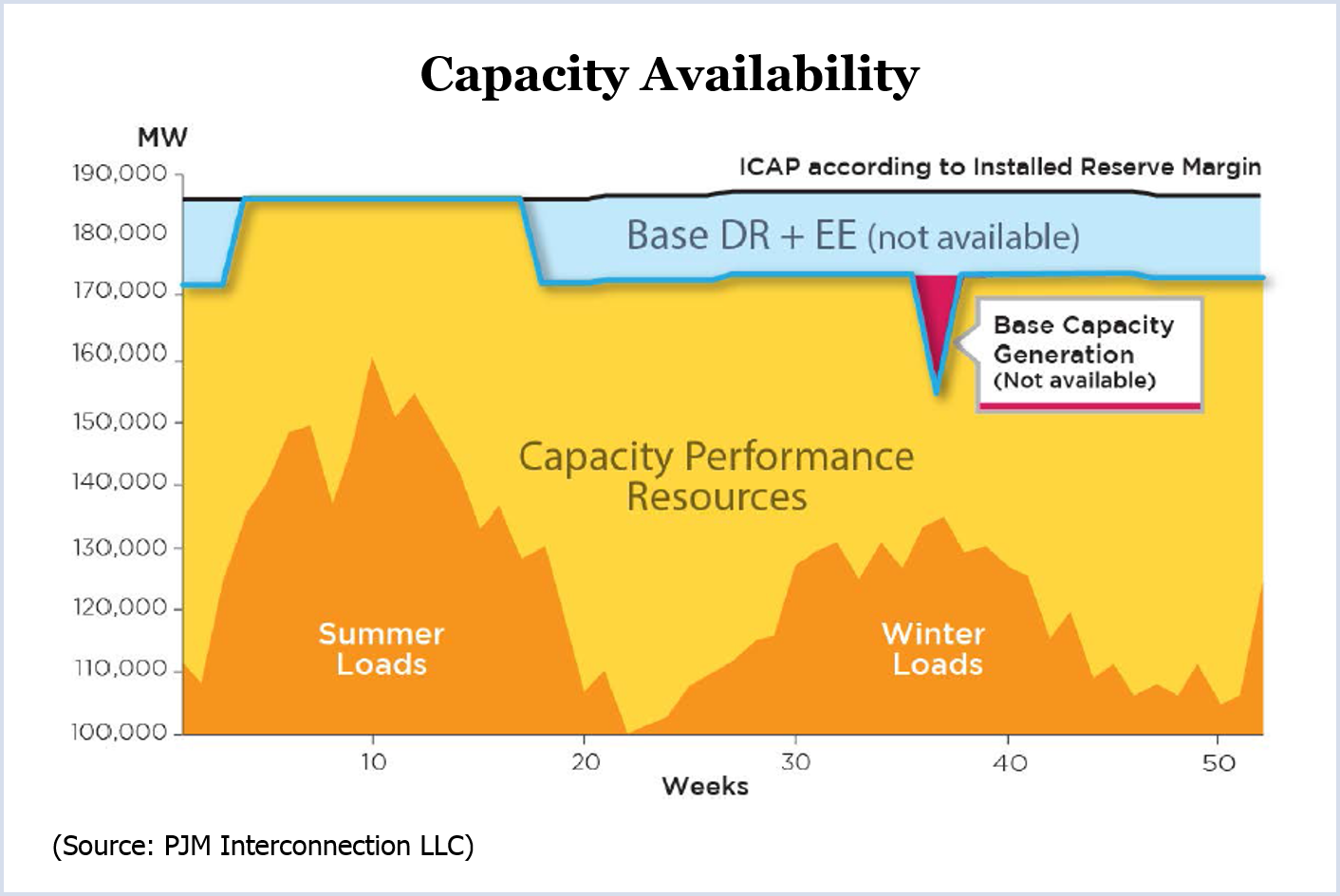

Members will be asked to approve a recommendation to leave PJM’s Installed Reserve Margin at 15.7% for planning year 2018/19, unchanged from 2017/18. The Planning Committee approved the recommendation earlier this month. (See Planning Committee Briefs.)

8. Reactive Supply and Voltage Control Service from Deactivating Resources (11:00-11:15)

The MRC will be asked to approve on first read a proposed problem statement and issue charge seeking to prevent generation fleet owners from collecting payments for reactive power and voltage control service from generators that are no longer running.

9. Manual 29 Revisions – Billing Adjustments (11:15-11:30)

The committee will be asked to approve a proposed problem statement and issue charge on first read regarding revisions to Manual 29: Billing, regarding treatment of underpayments of miscellaneous items or special adjustments. The changes are intended to prevent cost shifting when miscellaneous items or special adjustments are underpaid.

10. Regional Planning Process Senior Task Force (RPPTF) – Window Proposal Fee (11:30-11:45)

Members will consider a proposal by the RPPTF to charge a nonrefundable $30,000 fee for “greenfield” transmission proposals submitted during project proposal windows as a result of FERC Order 1000.

Members Committee

2. CONSENT AGENDA (1:20-1:25)

- The MC will be asked to endorse revisions to Manual 11: Energy & Ancillary Services Market Operations and Manual 15: Cost Development Guidelines to correct a typographical error. The words “mileage ratio” will be replaced with “mileage” in Section 3.2.7 of Manual 11 and Section 2.8 of Manual 15, where the calculation of adjusted regulation performance cost is described. There is no change in PJM’s calculations, which have been correctly using mileage as it is defined by PJM.

- Members will consider revising its conflict of interest policy to reflect the increasing number of consumer product companies, manufacturers and technology companies becoming involved in the electric industry. (See PJM Revising Policy on Prohibited Investments.)

3. Nominating Committee (1:25-1:30)

The MC will elect members of the 2015 Nominating Committee.

4. Energy Market Offer Price Cap (1:30-2:00)

Bob O’Connell of J.P. Morgan Ventures Energy will attempt to win approval for Tariff and Operating Agreement revisions eliminating the $1,000/MWh energy market offer price cap effective June 1, 2015. (See above.)