Over the past year, “capacity” — the assurance that electricity will be there when one flips the switch — increasingly has dominated the electricity conversation. PJM has been the epicenter of that conversation.

That market has seen its previous three capacity auction revenues skyrocket by tens of billions of dollars, driven largely by unexpected and rapid load growth from data centers as well as the adoption of a more rigorous method for accrediting the capacity of various resources.

Seeking to avoid a similar problem, ISO-NE is reforming its approach to acquiring sufficient capacity, submitting a proposal to FERC on Dec. 30. The filing is ISO-NE’s biggest change in this area since such markets first were established 18 years ago, evolving from its traditional three-year lead time model to a “prompt” approach, beginning in 2028.

Closing the 3-Year Gap

With the new proposal, ISO-NE will shake things up considerably. Citing growing uncertainty in load forecasting — a result of hard-to-predict end uses such as “the construction of data centers, and changes in public policy that could impact the pace of electrification,” as well as increasingly volatile weather and the variability of renewables output — the grid operator proposes to reduce the three-year lead time to only a single month.

The three-year schedule originally was intended to provide economic signals that provided sufficient time for developers to build new resources. But given the evolution of markets and technologies, that logic has unraveled.

When I oversaw Constellation Energy’s demand response group back when the formal DR markets were created around 2005, we found that prices whipsawed significantly from one year to the next. Consequently, it was nearly impossible to assess the long-term value of planned investments. A single annual price signal — even three years in advance — was not very valuable. It was bad enough for existing DR end-use assets that could be enrolled within a year; for multibillion-dollar generation units with lifespans of 30-40 years, such annual price indicators were next to useless.

Furthermore, the reality of today’s generation asset development — characterized by sclerotic interconnection queues, lengthy and complex state and local permitting processes, and a brutally slow supply chain — means that nothing gets built within a three-year time frame even in the most optimistic scenario. To take one example, one cannot even get a new gas turbine from GE until 2028/29 at present.

The result of the old three-year forward system was an abundance of “phantom assets” haunting the resource mix — projects that cleared the auction but never were developed. Those shortfalls in capacity subsequently had to be addressed through intermediary reconfiguration auctions. The new prompt auction, taking place just a month ahead of delivery, helps ensure that ISO-NE will secure capacity from actual resources capable of delivering, rather than empty promises from developers who may never see steel in the ground.

Seasonality: Addressing the Worst Days of Winter

The New England grid operator also changed its approach to seasonality, an approach that is long overdue. While summer heat may challenge the grid, New England’s lengthy winter cold snaps are where the greatest risk lies. With only two pipelines feeding the region, on the coldest days there is simply insufficient gas to generate power and keep people warm and safe. In that equation, power generation loses. At that point, the region resorts to its store of fuel oil, which is not limitless.

During the extended cold weather of 2017/18, for example, New England’s generators burned through nearly 3 million gallons of fuel oil reserves, with 2 million gallons consumed over just eight days. As can be seen in the graphic, oil reserves plummeted from 34% to 19% availability during the coldest 24-hour period, meaning the region was perhaps a single day away from rolling blackouts.

ISO-NE’s revised approach to capacity planning will address that seasonal challenge by establishing a bifurcated system with summer (June 1 to Oct. 31) and winter (Nov. 1 to May 31) periods. This scheme will differentiate resources based on performance during each season. So, for example, solar may fare well during the summer, while assets with on-site fuel would have an advantage in the winter.

Resource Capacity Accreditation: Who Shows Up When the Party Starts?

ISO-NE’s greatest proposed technical change is the way in which capacity resources are “counted.” The existing summer performance-based accreditation process will give way to an approach intended to “accurately capture the marginal reliability contribution of resources during the periods that will be of highest risk to reliability.” In other words, resources will be rated based on their effectiveness at staving off a blackout when the system is under maximum stress.

The grid operator will evaluate characteristics such as forced outages, output variability and access to fuel. For the reasons discussed above, gas-fired generation may be significantly impacted, with ISO-NE reflecting the effect of “pipeline constraints that can limit the ability of the region’s gas-fired resource fleet to obtain fuel during the winter.”

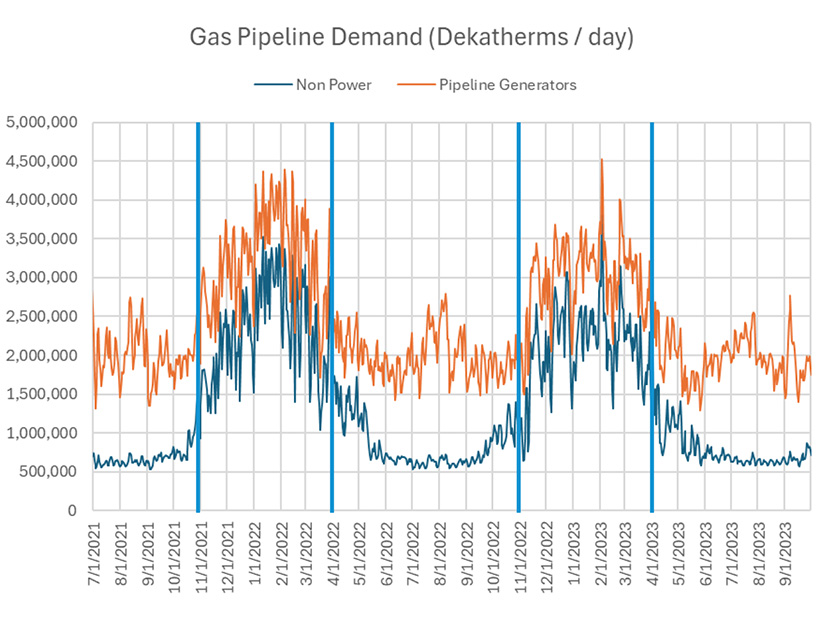

Gas units without firm supply contracts are likely to be penalized by this approach, and they should be. They rarely show up to the party when needed, on those days when power generation and other demands are both clamoring for the same gas molecule. As illustrated in ISO-NE’s planning document, those two demand peaks are highly coincident.

ISO-NE is not the only grid operator seeing this dynamic. 2021’s Winter Storm Uri in Texas and 2022’s Winter Storm Elliott in the Mid-Atlantic aptly demonstrated the fact that a megawatt of gas-fired capacity is useless if gas is frozen in at the wellhead or if pipeline pressures fall and generating turbines are starved of fuel.

After Elliott, PJM significantly reduced the accredited capacity off gas plants, with combined cycle plants falling from 96% to 79% over one year as a result. ISO-NE’s new rules may have a similar effect, so that a 1,000-MW gas plant might be credited for only 700 MW or 800 MW of “reliable” capacity.

A Better Way of Saying Goodbye

ISO-NE is reforming its resource retirement process. Currently, a power plant must signal its retirement four years in advance. With the new approach, plant owners can submit a retirement notification one year in advance. This approach gives owners far better knowledge as to the remaining life of their equipment and the near-term market conditions, allowing them to remain in the market if conditions are favorable.

The Inflationary Bottom Line for the New England Power Market

ISO-NE has asked FERC to approve these revisions by March 31, 2026, with the first affected auction occurring in May 2028 for delivery starting in June. The new approach is more realistic, but it may well have a significant inflationary effect for two reasons.

First, if the experience of PJM holds true, ISO-NE could find itself short of accredited capacity because of its revised accreditation approach. With 42% of 2025’s capacity supplied by gas generators, a significant de-rating could cut supply and drive prices up, especially if the demand side heats up.

Second, the seasonal approach may further affect future available capacity figures, especially with the winter re-rating of gas-fired generation, creating additional shortfalls.

And finally, with the capacity auction only a month prior to delivery, there’s zero time for the supply side to react to higher prices.

It’s probable we’re entering an era in which our “friendly little electron” demands a much higher price for the privilege of being there exactly when we need it. So, customers must be prepared to focus more intently than ever before on managing their demand — on a seasonal basis — even as they reluctantly reach for their checkbooks.

Around the Corner columnist Peter Kelly-Detwiler of NorthBridge Energy Partners is an industry expert in the complex interaction between power markets and evolving technologies on both sides of the meter.