ERCOT says it has successfully deployed Real-time Co-optimization + Batteries (RTC+B) into the market, a mechanism used in most other power markets that procures energy and ancillary services in real time every five minutes.

The new functionality, which went live for the Dec. 5 operating day, also includes improvements to modeling and consideration of batteries and their state-of-charge available to provide energy and ancillary services.

CEO Pablo Vegas said RTC+B is the “most substantial” improvement to the real-time nodal market design since its inception in 2010.

“The implementation of this program marks a significant step forward toward more efficient markets and improved grid reliability,” he said in a news release.

The grid operator said RTC+B’s market design is a “key element” in the market’s strategic development and will yield more than $1 billion in annual wholesale market savings. It said RTC+B will provide more flexibility in real time for ERCOT to more efficiently procure energy and ancillary services. (See How ERCOT’s RTC+B is a Game-changer for Market Operations.)

The ISO listed other operational improvements from using resources more effectively:

-

- using a variety of resources to better manage transmission congestion;

- reducing operators’ manual actions and commitments;

- modeling batteries as a single device to effectively dispatch their stored energy; and

- replacing inefficient supplemental reserve markets.

ERCOT staff and market participants have been gearing up for go-live since the program was restarted in 2023. The RTC+B Task Force spent 27 meetings drafting more than 25 protocol changes related to the project and producing training videos. Since May, the task force has been overseeing testing and interactive market trials to stabilize the systems.

ERCOT’s Matt Mereness, who chaired the task force, said stakeholders’ collaboration and coordination resulted in a “smooth, seamless” cutover.

“This is something ERCOT could not have done alone, so thank you for the journey since May 5,” he told stakeholders during a final cutover call Dec. 5. “My gosh! We went live last night. Thank you so much.”

The cutover to RTC+B took place at midnight Dec. 4, when telemetry was switched to RTC. Staff reconfigured the market systems’ network, creating a risk of disconnecting some qualified scheduling entities (QSEs) — market participants responsible for scheduling energy and financial settlements on behalf of generators, ESRs and other energy providers — that eventually was resolved.

Mereness said “quite a few and [a] not-insignificant” number of QSEs had problems setting their application programming interface (a set of rules and protocols that allows software applications to communicate and interact with each other) to the right endpoint.

“We all needed to step across the line together, and we weren’t all making it across the line at the same time,” Mereness said. He said everyone’s connectivity was reconciled and aligned and by 1:53 a.m., “We were operating on RTC+B.”

ERCOT expected 95 QSEs to participate in RTC+B.

Staff closed the day-ahead market at 10 a.m., and ERCOT was off and running with its first real-time co-optimized day-ahead market.

The deployment ends an effort that began in 2019 after a Public Utility Commission directive to ERCOT. It was delayed for several years after 2021’s Winter Storm Uri led to more pressing work for ERCOT staff.

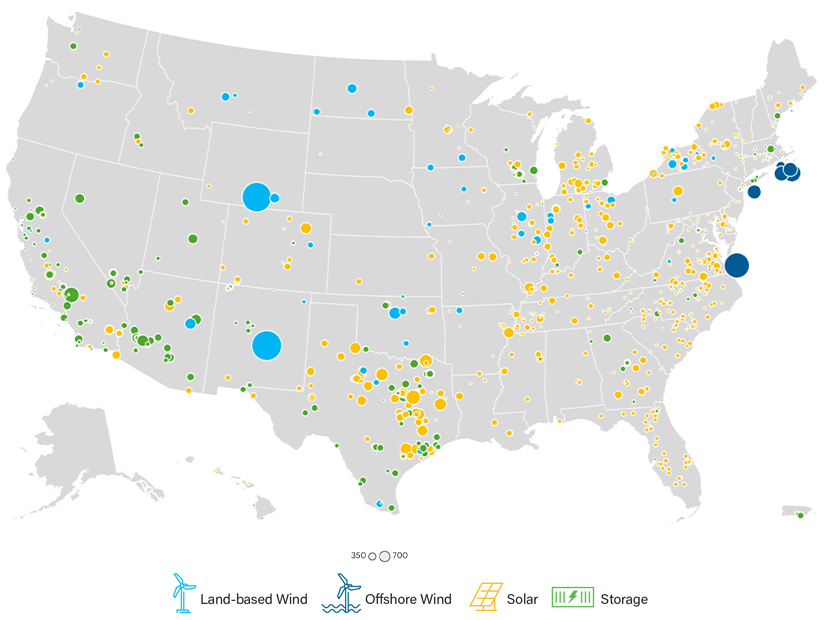

The project added battery energy storage resources with the state’s growth of storage. Texas is second only to California in terms of installed capacity, having doubled battery capacity between 2023 and 2025 and now approaching 10 GW.

ERCOT said it will work through the stakeholder-led Technical Advisory Committee in helping determine which initiatives to advance now that RTC+B has been implemented.