Clearing prices in IESO’s latest capacity auction hit a record $645/MW-day (CAD) for summer 2026, nearly double the $332 from last year’s, and $725/MW-day for winter, more than five times the previous $139.

Although IESO said the impact on ratepayers will be minimal, observers said the jump is further evidence of tightening supply/demand conditions in Ontario and other organized markets in the Eastern Interconnection.

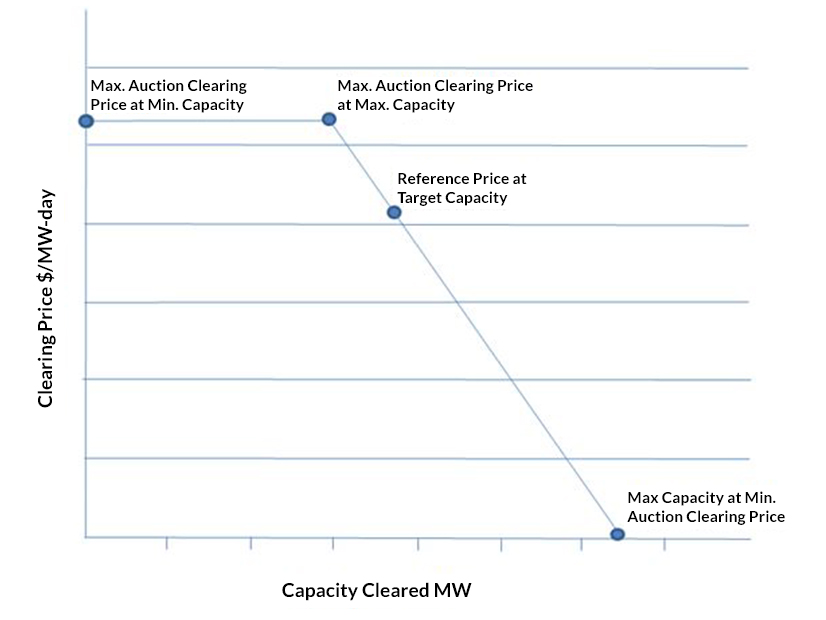

IESO said it procured 1,833 MW of supply for summer 2026 (above the ISO’s 1,800-MW target) and 1,125 MW for winter 2026/27 (below its 1,200-MW target).

Ratepayers will feel little impact from the rising prices, IESO said, because its medium- and long-term procurements play a larger role in the ISO’s Resource Adequacy Framework (RAF). “The total cost of the capacity secured is expected to represent approximately 1% of total system costs,” the ISO said in a statement Dec. 4.

Suppliers who secure an obligation receive payments for making their capacity available in the energy market.

IESO spokesman Michael Dodsworth said prices rose because of higher procurement targets and reduced participation by suppliers, some of which secured contracts through other windows of the RAF. Participation also dropped because of a lack of offers by generation-backed imports from NYISO.

“Last year’s auction was very successful in securing capacity at a low cost. While this year’s prices were higher relative to last year’s auction, they are still comparable with the majority of supply under contract,” Dodsworth said. “We’re still procuring the vast majority of electricity through long-term contracts or other procurements or other mechanisms that have the rates regulated by our provincial regulator,” the Ontario Energy Board.

He noted that the ISO raised its target procurements by 200 MW, with summer 2026 rising to 1,800 MW from 1,600 MW and winter 2026/27 to 1,200 MW from 1,000 MW.

Tom Chapman, an energy economist with The Brattle Group who previously served as IESO’s senior manager for wholesale market development, agreed that the immediate price impact will be minimal because the auction makes up only about 5% of Ontario’s installed capacity.

Chapman said the ISO’s 200-MW increase in its summer and winter targets was just one variable that led to the higher prices. “I think the surprise was perhaps on the supply side. While demand response did increase its contribution by about 40 MW, a large New York gas generator did not participate in the auction, and their contribution in previous years was about 300 MW. So, [with the] combination of the increase in target capacity and the reduction in supply, there’s about a 400-MW swing from this year to last year.”

Takeaways

Power Advisory, a consultant for industrial and commercial customers, cited these takeaways in a report to clients:

-

- In contrast to the previous two auctions, summer prices in the Northwest and Northeast zones were the same as other zones with no locational spreads.

- Though the procurement target was higher, the amount of capacity procured for the winter was lower than that in the previous three annual auctions.

- Most of the winter capacity procured was from virtual resources — aggregated DR resources that are not metered by IESO — while physical resources, including imports, dominated summer capacity. The import capacity limit from Hydro-Quebec increased from 400 MW to 600 MW. But the increase in aggregated DR imports from Quebec was insufficient to fully offset the lost supply from gas plants that won contracts in the most recent medium-term procurement (MT-2).

MT-2 Impact

IESO purchased more than 3,000 MW of capacity in the MT-2 procurement, completed in June, most of it from 27 natural gas and wind generators. (See IESO Purchasing 3,000 MW of Energy and Capacity.)

Power Advisory identified five resources that participated in previous auctions and did not receive commitments in this round, including two New York imports — GB II New York and Oswego Harbor Power — and three thermal generators that received MT-2 contracts: Iroquois Falls Power, Kingston Cogen and KAP Power.

“The reduction in summer supply from these resources totaled more than 470 MW,” Power Advisory said. “The MT-2 prices for most successful generators are below the effective annual capacity auction price.”

In MT-2, IESO purchased 2,006 MW of natural gas-fired capacity beginning in May 2026 and 2029 with a weighted average price of $598/MW-business day.

Tightening Supply in Northeast Markets

Brattle’s Chapman said the auction was just the latest indication of tightening supply/demand conditions.

“When you take these results, along with other recent results — in PJM, it cleared at the cap; MISO, where they had record clearing prices; Quebec, where they were a net importer in 2024 and they’re facing strong load growth and challenging hydrological conditions — I think it speaks to a broader tightening of supply and demand across the Northeast markets,” Chapman said. (See PJM Capacity Prices Hit $329/MW-day Price Cap and MISO Summer Capacity Prices Shoot to $666.50 in 2025/26 Auction.)

Chapman noted that NERC’s Winter Reliability Assessment showed 20 GW of new load since last winter. “It’s tough to build 20 GW of supply at the best of times, but [with a] challenging supply chain and … all the interconnection issues, there’s [an] imbalance, which the markets are highlighting.” (See NERC Winter Reliability Assessment Finds Many Regions Facing Elevated Risk.)

“I would say that we should be thankful to the wholesale markets for signaling the underlying market fundamentals in a very transparent, clear way that sends a very powerful signal to system planners, regulators [and] policymakers on exactly what’s needed and where it’s needed.”

Power Advisory also saw the results as the latest sign of tightening supplies. “Energy and operating reserve prices … have been well above historical levels over the past year. We expect energy prices to remain elevated given forecasted demand growth and the retirement of the Pickering Nuclear Generating Station, which will remove 2,100 MW of baseload supply at the end of 2026.” (See related story, Ontario Greenlights Overhaul of Pickering Nuclear Station.)

“In short, Ontario’s grid is getting very ‘tight,’ and while that first appeared in the energy market, it is now showing up in the capacity market,” Power Advisory continued. “With that tightening supply/demand balance across such a large region, procuring capacity through the province’s interties will either become challenging from a physical perspective (i.e., the capacity is not available) or expensive.”

“If resources from outside Ontario can participate in other capacity auctions (New York and potentially PJM in particular), they need to consider the potential revenues from those auctions compared to Ontario,” Brady Yauch, Power Advisory’s director of markets and regulatory, explained in an email. “If those prices move higher, the opportunity cost of locking up supply in Ontario is higher, and they would have to adjust their offer accordingly (or would not participate at all).”

Demand Response

Chapman said he was encouraged by the increase in DR.

“This auction is showing that there’s still untapped demand response capacity in Ontario, because the demand response providers were able to extract a further 40 MW. And that’s even after 10 years of auctions, which is pretty encouraging that there’s still that sort of potential in a mature market like Ontario.”

Rodan Energy Solutions, which says it is Ontario’s largest DR provider with over 300 MW under management, said it secured the largest virtual capacity position in the auction.

Power Advisory was less bullish on the potential for additional growth in DR.

“Higher clearing prices should encourage more load customers to offer DR; however, it is not clear how much achievable DR potential remains in Ontario and how quickly new DR supply could enter the market,” it said. “If there is insufficient new capacity in future auctions, participants may feel comfortable pushing offer prices higher. Ontario is facing a new reality when it comes to its supply/demand balance and prices.”

Reliability Concerns

Chapman said the results show system planners need to expedite their decision-making and give interconnection priority to dispatchable resources.

“Everything will be fine as long as conditions remain normal. There’s adequate supply. … But if we see any deviation from that — as SPP and ERCOT saw in 2021 with Winter Storm Uri — it could lead to reliability impacts,” he said. “I think that should really focus people’s minds on the … need for urgent and quick decision-making. It may require some hard decisions … like which resources should be given priority to connect.

“This is one area I feel that Ontario — I’m not sure whether [by] luck or design — has perhaps got it right under the current market conditions,” he continued. “It’s a single jurisdiction, and it has launched expedited procurements to meet an identified need. It isn’t as overly reliant on a single auction to meet all of its capacity needs; [it doesn’t] have all its eggs in one basket. And it seems to have a balance that’s perhaps better fit for current conditions than some of the other neighboring markets. I think some of the neighboring markets could learn a few lessons from the Ontario experience, if they are so interested.”

[Editor’s Note: An earlier version of this article quoted an IESO spokesman as saying the ISO’s 200-MW increase in its target procurements for summer 2026 and winter 2026/27 was “unexpected.” The increase actually was included in the 2025 Annual Planning Outlook as firm guidance and in the 2024 APO as forward guidance.]