Several new reports and updates give snapshots and predictions about the changing direction of the U.S. energy sector.

Some of the organizations behind the updates identify as neutral and nonpartisan, but others are openly critical of the shift that began when Americans chose Donald Trump and his “Drill Baby Drill” message at the polls nearly a year ago.

But while the reports each have a different focus and tone, all reach similar conclusions: Major changes are afoot, and they will have significant effects.

-

- After four years grading the top U.S. utilities at a collective D in its annual “Dirty Truth Report,” the Sierra Club gives them an F in its 2025 edition for delivering dirtier power at a higher cost.

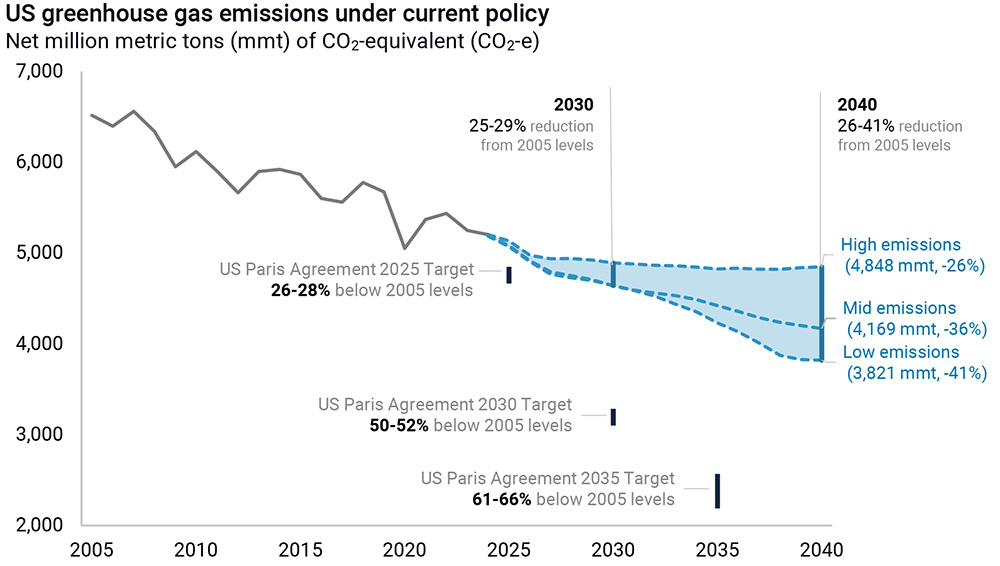

- Rhodium Group in its annual “Taking Stock” report estimates the U.S. energy sector’s 2035 greenhouse gas emissions will be 26 to 35% lower than in 2005; only a year ago, Rhodium estimated a 38 to 56% reduction over the same period.

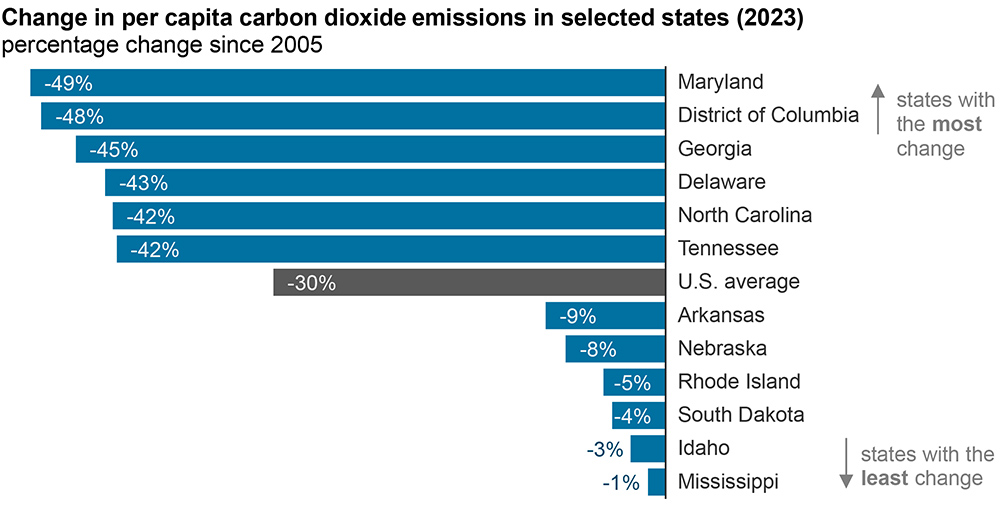

- The U.S. Energy Information Administration calculates that energy-related per-capita carbon dioxide emissions decreased in every state from 2005 to 2023 — 30%, on average — but forecasts a 1% increase in total U.S. CO2 emissions in 2025 due to increased fossil fuel consumption.

- In its latest update, Climate Action Tracker downgrades its rating for the U.S. from “insufficient” to “critically insufficient” due to the “most significant rollback of policies” it has ever analyzed.

- E2 reports in “Clean Jobs America 2025” that employment in the clean energy economy grew 17% from 2020 to 2024, far outstripping the rest of the energy industry and the U.S. economy as a whole, but says policy changes threaten future growth.

- The “2025 Production Gap Report” by Stockholm Environment Institute, Climate Analytics and International Institute for Sustainable Development looks at 20 countries and finds widespread plans to increase fossil fuel production. But it reserves a particularly blunt assessment for the world’s largest oil and gas producer: “The United States offers the starkest case of a country recommitting to fossil fuels, with plans to scale up its oil and gas production, arrest the decline of coal, slow clean energy development and electrification, and turn away from international cooperation on energy and climate change.”

Details and Conclusions

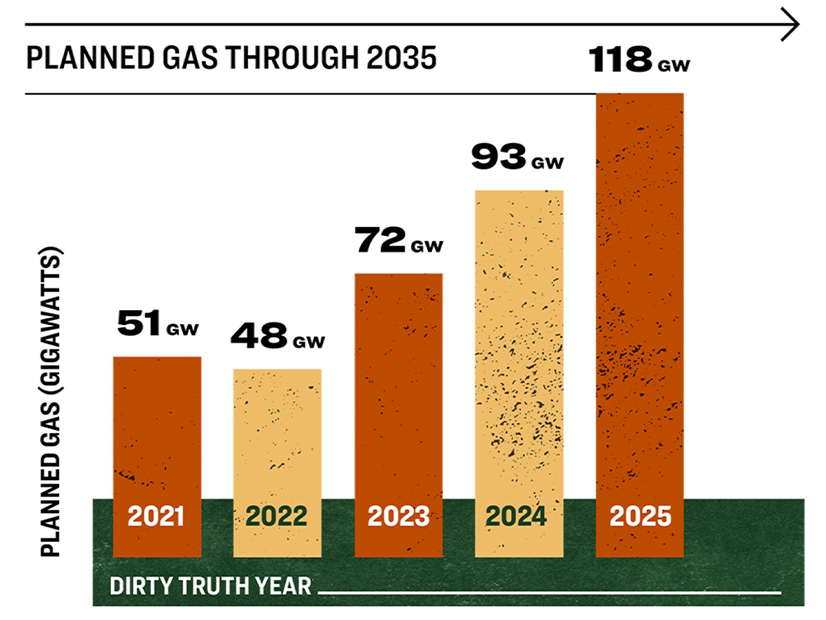

The Sierra Club’s goals are lofty indeed — 100% coal retirement by 2030, 100% clean energy by 2035 and zero MW of new gas capacity planned by 2035.

It said the utilities it studied had committed to only 29% on coal and 32% on renewables and are planning 118 GW of new gas, all while mounting a greenwashing campaign and raising rates faster than inflation.

The Sierra Club gave out a handful of B’s in the 2025 edition of the “Dirty Truth Report” — Orlando Utilities Commission, Xcel Energy and Consumers Energy were ranked highest at 73, 69 and 65% — but together, the 75 utilities had an aggregate score of 15%, the lowest since the first edition of the report, in 2021.

Sierra Club asserts that despite the dual pressures of load growth and vanishing federal support for clean energy, utilities must accelerate their decarbonization, not slow it down.

In “Taking Stock 2025,” Rhodium prefaces its prediction of slower progress on greenhouse gas reductions with the root cause:

“The first seven months of the second Trump administration and 119th Congress have seen the most abrupt shift in energy and climate policy in recent memory. After the Biden administration adopted meaningful policies to drive decarbonization, Congress and the White House are now enacting a policy regime that is openly hostile to wind, solar and electric vehicles and seeks to promote increased fossil fuel production and use.”

Rhodium predicts that the rate of decline of GHG emissions will slow but does not attempt an exact prediction because so many variables are in play — fossil fuel prices, the growth of the U.S. economy, the cost of clean energy technology and the growth in U.S. LNG export capacity.

There also is an “incredibly dynamic” policy environment, continued demand for clean technologies and persistent non-cost barriers to renewables, it adds.

Rhodium assumes the 31 regulatory policies EPA Administrator Lee Zeldin has targeted for “reconsideration” will be removed.

The EIA said the sharp reduction in energy-related CO2 emission reductions so far this century can be attributed primarily to reduced combustion of coal for power generation; increased use of natural gas, which burns cleaner; and the rise of emissions-free wind and solar generation.

U.S. energy-related CO2 emissions dropped 20% from 2005 to 2023 while the population grew 14%, a 30% per-capita decrease.

In 2016, transportation surpassed electric power as the largest energy-related CO2 source in the U.S., EIA said.

The Climate Action Tracker (CAT) rated 40 countries and found none had policies in place to meet the goals of the 2015 Paris Agreement. Eight nations are “almost sufficient”; the U.S. and nine others are “critically insufficient”; and the other 23 fall in between.

“The Trump administration is pursuing an agenda to systematically repeal federal climate targets, policies and funding for climate change mitigation, blocking progressive actors,” the report said, “while encouraging the production and consumption of fossil fuels at home and abroad, completely reversing the previous administrations’ course on climate action.”

Pro-climate policies continue in some U.S. states, but the nation as a whole has stepped away from net-zero aspirations, CAT said.

“It is shocking how rapidly and how systematically the Trump administration has moved to roll back efforts to reduce greenhouse gas emissions, while aggressively expanding support for the production and consumption of fossil fuels, in defiance of clear market signals,” said the assessment’s lead author, Finn Hossfeld of the NewClimate Institute.

E2 tallied more than 3.5 million workers in 50 states in its 10th annual analysis of U.S. clean energy employment, 522,000 of them in jobs created since 2020. It said 82% of net new energy sector jobs in 2024 were in clean energy.

“This trend was expected to continue as clean energy accounted for larger and larger shares of energy industry jobs and the nationwide workforce,” the authors wrote. “But recent policy decisions to revoke incentives, cancel permits, and target the industry with new red tape and legal hurdles threatens future growth and, increasingly, the health of the U.S. economy at large.”

E2 offered no specific job-loss predictions of its own but said $22 billion worth of projects and factories have been canceled at a cost of 16,500 jobs, and it said other organizations have predicted more than 830,000 jobs economywide could be lost by 2030 due to U.S. energy policy changes.

“Clean Jobs America 2025” runs 42 pages, most of them filled with geographic- and industry-specific data drawn from the U.S. Bureau of Labor Statistics via the U.S. Department of Energy’s 2025 U.S. Energy and Employment Report.

Derik Broekhoff, coordinating lead author of “2025 Production Gap Report,” said: “As our report makes clear, while many countries have committed to a clean energy transition, many others appear to be stuck using a fossil-fuel-dependent playbook, planning even more production than they were two years ago.”

The 2025 report finds that governments worldwide plan to produce a 120% greater volume of fossil fuels in 2030 than would be consistent with limiting global warming to 1.5 degrees Celsius, the target specified in the Paris Agreement.

But this last point is a bit academic for the U.S.: Trump withdrew the nation from the Paris Agreement early in his first term and withdrew it again on the first day of his second term.

None of the new reports and updates, whether critical or merely analytical, seem to have made any impact on the driving force behind the U.S. energy policy shifts that are influencing the data in those reports.

Speaking before the United Nations General Assembly on Sept. 23, Trump called climate change “the greatest con job ever perpetrated on the world,” provoking grumbles and murmurs from his audience.

“If you don’t get away from the green energy scam, your country is going to fail,” he said.