BOSTON — The New England wholesale electricity markets performed competitively in 2024, while decreased imports and higher emissions compliance rates increased overall market costs, the ISO-NE Internal Market Monitor told the NEPOOL Participants Committee on Sept. 4.

David Naughton, executive director of the IMM, discussed the group’s 2024 annual report, which originally was published in May.

The IMM found that wholesale market costs totaled about $10.2 billion in 2024, up by about $1 billion from 2023. This increase largely stemmed from higher energy market prices, which were caused by greater emissions compliance costs and a significant drop in imports from Quebec, which caused the region to rely more heavily on higher-priced natural gas generation, Naughton said. (See Drought, Climate Drive Uncertainty on New England Imports from Québec.)

Regional Greenhouse Gas Initiative (RGGI) costs increased by about 55% in 2024 compared to 2023, he noted, adding that this increase was offset partly by a 61% decline in Massachusetts’ cap-and-trade program. Overall, carbon compliance costs totaled $509 million for New England generators, Naughton said. This translated to $910 million in added wholesale market costs, as higher marginal resource costs increased the clearing price paid to all participants.

He noted that the New England states reinvest most of the RGGI proceeds in energy efficiency programs, which help mitigate the cost impacts of carbon prices.

“These energy efficiency programs saved approximately 17.5 TWh in energy, or roughly $757 million in wholesale energy market costs based on the 2024 LMP,” the IMM wrote in its annual report.

In 2025, wholesale costs are on track for a significant year-over-year increase, largely from low winter temperatures and periods of extreme heat in the summer, Naughton said.

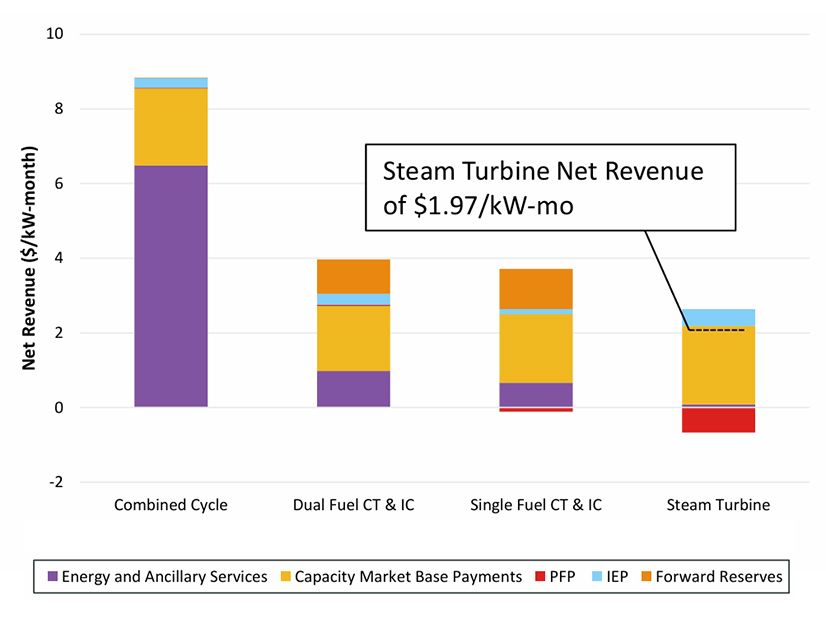

He noted that market revenues in 2024 were lower than the cost of entry for most new resources.

“Market-based revenues in 2024 were below the going-forward costs of new entrant gas-fired generators,” Naughton said. Market revenues for wind and solar resources also were well below the CONE, and these resources remain heavily reliant on state programs, he added.

Naughton also noted that, while combined cycle plants generally earn more from the capacity and ancillary service markets than in the capacity market, fossil peaker plants are increasingly reliant on capacity market revenues.

“These observations indicate that some older, less efficient units could face exit decisions if current market conditions persist, especially when faced with large capital and fixed operating expenses,” the IMM wrote in its report.

Naughton said the IMM has seen “gradual” impacts of the clean energy transition so far on supply and demand. Average solar output in the region doubled between 2020 and 2024, but wind output remained stagnant during this period.

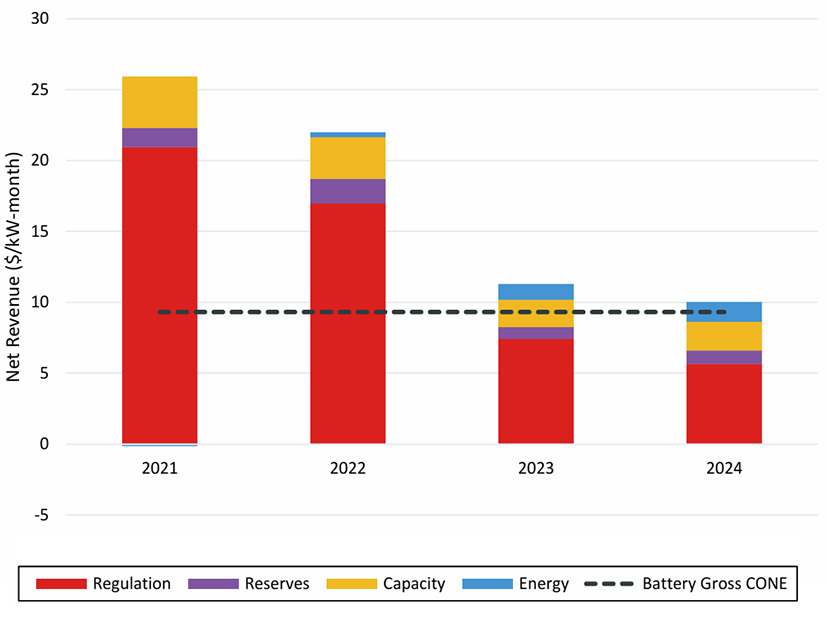

Behind-the-meter solar growth has led to a growing duck curve in the region, with mid-day demand frequently dropping below nighttime levels. This has caused growing morning and evening ramp requirements and is beginning to present increased arbitrage opportunities for energy storage resources, Naughton said.

While the saturation of the storage market has led to declining regulation revenues, energy market revenues have started to tick up for storage resources, he said.

Recommendations

Naughton also discusses the IMM’s recommended market changes, which include a proposal to subject exports to pay-for-performance (PFP) penalties during capacity scarcity events.

PFP payments are intended to incentivize resource performance during capacity shortages. While imports receive the PFP rate and LMP, “exporting-only participants are only charged the LMP,” Naughton said, adding that this “over-incentivizes procuring imports” instead of limiting exports.

He said participants that both import and export power during a scarcity event are subject to PFP netting rules, but there could be a “gaming opportunity” for related companies to schedule imports and exports during a scarcity event and profit without delivering actual energy.

To fix this issue, the Monitor has recommended that ISO-NE “apply the PFP rate symmetrically to exports, aligning financial incentives and ensuring that external transactions — whether imports or reduced exports — are valued equally for their contribution to system reliability.”

Responding to the proposal, some stakeholders expressed a concern about applying the PFP to capacity-backed exports and asked ISO-NE to exempt them from performance penalties.

The Monitor has recommended that ISO-NE update its bidding software “to allow low-cost resources to more easily submit real-time specific offers” and change the external interface clearing rules “to reduce incentives for strategic virtual bidding and incentivize participants to submit more accurate, cost-reflective offers closer to the operating day.”

Asset-condition Review

During the MC meeting, ISO-NE COO Vamsi Chadalavada discussed the RTO’s work to establish an asset-condition reviewer role.

The RTO has agreed to pursue this role at the urging of states and consumer advocates and with the agreement of the transmission owners. It has stressed it will not take on a regulatory function investigating the prudence of investments. Instead, its role would be aimed at increasing transparency into projects and could, hypothetically, provide information that would aid stakeholders in prudence challenges with FERC. (See ISO-NE Open to Asset Condition Review Role amid Rising Costs.)

Chadalavada said ISO-NE’s work is complicated by the fact that no similar role exists elsewhere in the U.S., requiring the RTO to develop these capabilities from scratch. Once developed, the role could serve as an example for the rest of the country, he added.

He noted that ISO-NE has hired Electrical Consultants Inc. to “help develop a framework for a new asset-condition reviewer role,” as well as to “review selected asset-condition projects in the interim review cycle, through the end of 2026.”

ISO-NE stillis working to determine which projects it will include in this interim review process generally but will focus on high-cost or abnormal projects, he said.