When a government’s word is no longer its bond, investors get nervous, and investors in clean energy generation plants in the United States are very nervous indeed. For good reason: The administration is threatening wind and solar generation projects with tactics ranging from revoking permits to trimming tax credits to reneging on grants.

Capriciousness is the Market’s Kryptonite

Project developers are, by nature and necessity, risk averse. There’s no reward if a project gets derailed by a desert tortoise after years of planning, permitting and perfecting the capital stack to fund its construction. But how can the industry do due diligence when a political wild card can be dealt at the last minute?

A recent example, where the Bureau of Ocean Energy Management halted the Revolution Wind offshore project for belated and questionable “national security concerns,” is the wildest wild card yet. After all, if this can happen to an 80% complete project that underwent more than a decade of studies and hearings to obtain permission, no project seems safe.

As Nancy Sopko, vice president of external affairs for a U.S. Wind project off the coast of Delaware, another project under threat, said, the permits the administration is threatening to revoke for that project were “secured after a multi-year and rigorous public review process” and were legally sound. But a drawn-out legal battle, even if the project team prevails, is just another cost that will make a project difficult to pencil out.

The market is becoming increasingly cautious about investing in clean energy generation and is re-evaluating projects already in the planning stage. Already, the pipeline of generation projects is pre-emptively narrowing as investors and developers seek safer shores.

Putting aside the why of the political agenda, it’s essential to ask how this will impact electricity supply in a time of rising demand. The grid may face capacity and reliability challenges if clean energy generation projects are shelved, whether voluntarily or otherwise.

AI, Data and the Demand Crystal Ball

In a steady state, cancellation or delay of major projects would be problematic, but unlikely to lead to shortages. However, in the past two years, the rise of AI and the related proliferation of data centers have sent energy analysts scrambling to rework demand projections.

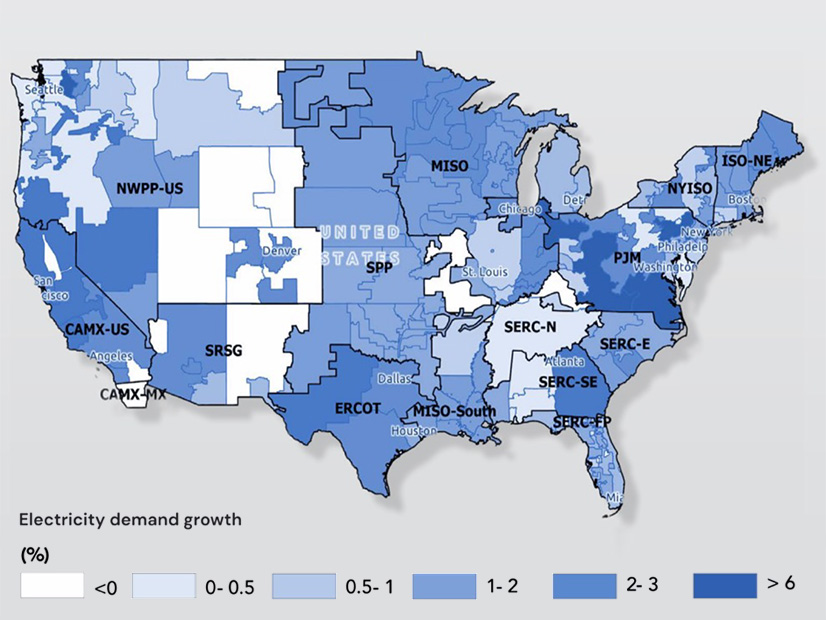

In early 2023, consulting firm ICF International projected a 1.3% annual growth rate through 2030. Two years later, it more than doubled the projected growth rate to 3.2%. And thanks to the joy of compounding, those small annual increases result in 25% growth in U.S. electricity demand by 2030 and 78% by 2050, compared to 2023 levels.

Peak load growth projections also have been revised upward; however, with data centers’ “always-on” load profile, the result is a more feasible 14% by 2030 and 54% by 2050. While data centers providing cloud computing and AI account for most of the growth in demand, it also is coming from a rise in manufacturing, cryptocurrency mining and building electrification.

One trend that may offset some of the increase in demand is the administration’s shift away from electrifying transportation, which still may grow, but at a lower rate than previously predicted. Other actions seem performative: For example, the move to eliminate or privatize the Energy Star program is not going to lead white goods manufacturers to flood the market with less efficient appliances.

Reliability on the Rails

To ensure a reliable supply during peak demand, utilities and grid operators strive for a reserve margin of at least 15%. While today there’s a larger reserve margin, ICF warns, “mapping demand growth estimates against generating capacity online today, including the impact of firm builds and retirements, shows that much of the U.S. will experience below-target reserve margins as soon as 2030.”

These analysts, however, use the phrase “firm builds and retirements,” but planning is being done now in an environment where many “firm builds” have been demoted to “likely build unless the technologies being targeted by the administration.”

If there’s continued proactive withdrawal by developers, the reliability risk may grow. It will vary by region, but in New England, the offshore wind farm that now is in suspended animation was critical to manage winter power costs, Jon Lamson reported this week. In other regions, the peak summer load is a bigger worry, as longer and hotter heat waves drive up the cooling load.

The question of whether this changed environment will be able to supply enough electricity with acceptable reliability isn’t really about the newsworthy disruptions to offshore wind and the ability for other renewables to survive without tax credits; it’s about the ripple effect. Will the pipeline of planned clean energy projects dry up further, and what will fill the void?

Project Finance is Self-deporting

There are echoes of the administration’s immigration policies in the project development world: Make the development environment untenable and the developers will halt their projects without the Interior Department ever issuing a stop-work order. Until those behind a project are sure that their hard-won approvals will be honored, preemptive withdrawal is an increasingly prudent option.

Given the choice between investing time and money in a project that the political rug could be pulled out from under it before it’s ever commissioned or putting the project on ice today, some renewables developers and investors are choosing the latter.

BloombergNEF reports “the U.S. saw the greatest drop in new renewable energy investment in 1H 2025, with committed spending down $20.5 billion (36%) from the second half of 2024.” Some of the drop is attributable to the artificial bump caused by the rush to start projects before the end of 2024 to lock in tax credits. Still, worsening policy conditions also contributed to it.

The capital is, in essence, self-deporting, and the E.U. is the beneficiary, with an uptick in the number of low-carbon generation projects in its development pipeline. The EU-27 saw a 63% rise in investment in the first half of 2025 compared to the last half of 2024.

“These numbers support the idea that companies are reallocating capital out of the U.S. and into Europe — particularly in offshore wind, where several developers refocused to North Sea sites over U.S. projects,” BloombergNEF said.

One Foot on the Gas, the Other on the Brakes

It’s not all bad news for capacity: Fossil fuel generation, primarily gas, is benefiting from the administration’s focus. Global Energy Monitor’s tracker shows almost 100 GW of capacity in preconstruction, up from 15 GW a year earlier. The focus on fossil fuel-powered generation puts the United States at odds with its OECD counterparts. Close to 40% of pre-construction projects in the U.S. now are fossil, compared with less than 6% in the balance of the OECD countries.

A rush to build new fossil capacity won’t add to capacity or reliability if the projects can’t come online rapidly, and these newly planned plants are just beginning to navigate the yearslong interconnection queues. It’s no wonder that data center giants want to skip the grid altogether by building dedicated capacity and energy storage.

Even those projects, however, face a literal pipeline problem unless there is an existing gas supply they can tap into. And if their pipeline crosses state borders, FERC gets involved. “Currently, depending on size and jurisdiction, a pipeline project could take anywhere from eight months to five years,” Norton Rose Fulbright said. “The federal government has been working on natural gas pipeline permitting reform that would allow pipeline projects to be built more expeditiously.”

Similarly, some fossil plants that were scheduled to close are receiving a stay of execution, such as the emergency order from the U.S. Department of Energy to keep two units of the Eddystone Generating Station in Pennsylvania in operation. (See related story: Eddystone Ordered to Remain Operational for PJM 90 More Days.) The surge in fossil projects may offset some of the decline in renewables. However, even if you assume hydro and geothermal are left alone, there’s still a significant portion of planned new generation capacity at risk.

Of the 57 GW of power capacity under construction in North America in August, 23 GW is solar, and 17 GW is wind, according to Global Energy Monitor, meaning more than two-thirds of all power capacity under construction may be at risk. And of the 253 GW in pre-construction? Even after the sharp uptick in fossil plants in pre-construction, utility-scale solar and wind account for 114 GW, or 45%, of capacity in pre-construction.

The critical question is how much of that pre-construction and construction is one revoked permit away from being halted. Some developers — or the project financiers that enable them to exist — aren’t waiting around to find out.

What Do We Want? Clarity! When Do We Want It? Now!

The sooner clear and consistent policies are communicated, the faster the markets can start to rebuild trust. If the administration’s goal is to prevent all offshore wind projects and allow onshore wind and solar projects to flourish and grow as long as they can pencil out without tax credits, say so.

Investors already fear the worst, and moving to more stable markets but knowing how profound these market shocks will be and how long they will last will enable everyone — developers, investors, utilities, grid operators and regulators—to get back to working out how to build the capacity and reliability electric consumers will need in the coming decades.

Power Play Columnist Dej Knuckey is a climate and energy writer with decades of industry experience.