IESO officials say they will release more information on how the ISO constructed its study of the potential for incremental energy savings in Toronto after stakeholders complained they lack enough details to comment meaningfully on the analysis.

At a webinar Aug. 21, IESO said it and Toronto Hydro could cost-effectively secure 219 MW of incremental summer demand savings and 50 MW of incremental winter demand savings through energy efficiency, demand response and behind-the-meter DER programs.

The savings are in addition to the forecast 847 MW (summer) and 757 MW (winter) of future electric demand side management (eDSM) program savings already reflected in the Toronto Integrated Regional Resource Plan (IRRP), according to the study, which was conducted with consulting firm ICF.

The results from the ISO’s draft Local Achievable Potential Study will affect recommendations for how non-wire alternatives can defer or reduce the need for more electric infrastructure. “The results show that incremental eDSM alone is not able to meet Toronto’s needs,” the ISO said in a presentation.

IESO asked for feedback on the results by Sept. 11. The final report is set to be published on the Toronto Regional Planning website in October.

But several stakeholders said they would be unable to respond intelligently based on the information the ISO has released to date.

“It would be very helpful if you could provide us with the draft report that you’ve got so we can look at your input assumptions, look at your analysis and give you meaningful feedback,” said Jack Gibbons, chair of the Ontario Clean Air Alliance. “Because some of your assumptions may be wrong. Some of your analysis may be wrong. And we don’t want to just take your findings that you’ve given us today on faith.”

IESO’s Tom Aagaard noted that the ISO received feedback on its input assumptions in a webinar in December and said the ISO still was refining its conclusions. “We’ll have to take back [to see] what we’re able to share sooner.”

“You’ve got a draft report from ICF. I don’t see why you can’t just share it now and be transparent,” Gibbons persisted. “What harm is it going to do to give us what you’ve got now?”

Keith Brooks of Environmental Defence, Chris Caners, general manager of renewable energy co-op SolarShare, and David Robertson, of Seniors for Climate Action Now, agreed with Gibbons.

“Without an understanding of what the final assumptions are in more detail, it’s really, really impossible to give meaningful feedback,” Caners said.

IESO responded in an email the day after the webinar, saying it would work with ICF “to expedite the release of more detailed information on methodology and assumptions, including measure characterization and more information on achievable potential established from economic potential results.” The information will be posted on the Toronto Regional Planning engagement website.

Methodology

The study used two load forecasts:

-

- A reference scenario assuming a steady increase in demand based on current policies and growth in EVs and electrified heating and “low/steady growth” of data centers.

- A high-electrification scenario that assumes Toronto will meet its net-zero targets for buildings by 2040 (with 30% EV adoption by 2030 and 100% by 2040) and see “elevated” data center growth.

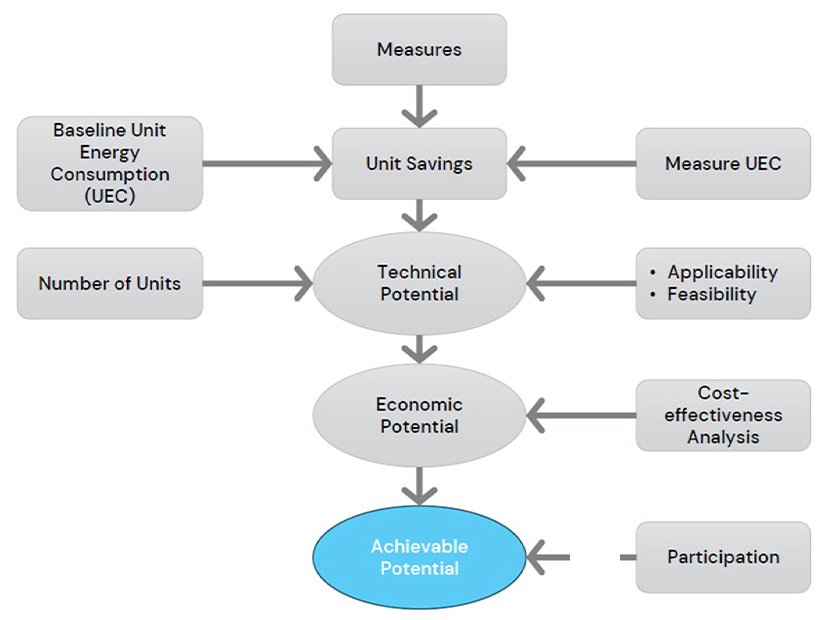

For each scenario, the study identified three levels of potential electricity savings:

-

- Technical Potential. Savings from implementing all technically feasible measures regardless of cost-effectiveness and customer awareness.

- Economic Potential. Savings from technically feasible measures that are cost-effective based on avoided generation (capacity and energy) and transmission costs and forecasted retail rates.

- Achievable Potential. Savings that realistically can be acquired based on expected adoption rates considering market barriers and customer awareness.

The study used “digital twins” of Toronto’s building stock, to which DSM measures were applied. The resulting savings were simulated at the building level and aggregated to the transformer station for each scenario.

Draft Results

In 2045, the study concluded that achievable savings under the reference scenario were 1,066 MW in summer and 806 MW in winter:

-

- Demand response (including EV charging, HVAC equipment and water heaters) had an achievable potential of 440 MW in summer and 324 MW in winter under the reference scenario. IESO said the difference in achievable potential between the reference and high-electrification scenarios is modest because the reference case includes significant heating electrification and because of the poor cost-effectiveness of EV demand response programs due to time-of-use pricing.

- Energy efficiency (heat pumps, HVAC, lighting, appliances, weatherization and hot water) could save 605 MW (summer) and 471 MW (winter).

- Behind-the-meter distributed energy resources (including battery storage and solar) could save 21 MW (summer) and 11 MW (winter). The low winter potential reflects the “limited value of solar to meeting winter needs,” the ISO said. Technical and economic potential match because measures in current Save on Energy programs including solar and solar-plus-storage were judged cost-effective. The reference and high scenarios had identical potential because the technical potential is affected by factors like usable rooftop area for solar rather than load.

Robertson and Brooks questioned the gaps between economic and achievable potential.

“It’s hard for us to give feedback on the results if we don’t understand how you arrived at them,” Brooks said.

“It would be really helpful and useful if there was something in your reports and presentations that talk about how do you close the gap,” said Robertson.

Existing Measures

IESO said the achievable savings in the study were muted because the Toronto IRRP already assumes 847 MW (summer) and 757 MW (winter) of new peak demand savings in 2045 from eDSM programs. In January, the Ontario government announced it would spend up to $10.9 billion on its eDSM programs through 2036.

The IESO and Toronto Hydro’s EE programs already have reduced peak demand by 800 MW in the past 15+ years.

The city’s Green Standard’s high energy performance requirements reduce the amount of additional cost-effective efficiency opportunities in new construction.

“Robust” participation in net metering, microFIT and other DER programs reduce the remaining rooftop solar potential, the ISO said.

Vehicle-to-grid

Another point of contention was the ISO’s decision to exclude bidirectional charging measures (vehicle-to-grid) from the study. The ISO said it could not properly model V2G based on current information and lacked confidence “that a program of meaningful scale could be delivered cost-effectively in the near future” because of the limited availability of vehicles capable of bidirectional charging, uncertain customer acceptance, costs and technological barriers.

Robertson questioned the ISO’s conclusion, saying “a study [with a] horizon to 2045 should anticipate developments” such as V2G.

Aagaard said it would be “kind of reckless” to include savings from V2G based on current information.

“We have very, very limited core data [to make] really important modeling assumptions to understand how much technical potential is actually out there. How many vehicles are actually going to have bidirectional charging capability? Do customers actually want this? Will [they] be willing to participate in programs when they’re called upon?” he said. “There’s just a million kind of consumer choice factors that come into play. … To include it in the modeling would be like really pulling numbers out of a hat.”