A group of industry insiders looking at ways to meet data centers’ electricity demand found a common thread within their varied opinions: The power sector and its regulators need to be a lot nimbler.

The United States Energy Association’s monthly virtual press briefing Aug. 20 focused on ways Big Tech is reshaping the electric utility sector or even upending it, with the potential for major data centers to add their own power generation.

Speakers drawn from the power and technology sectors fielded questions from a panel of journalists on what is at once a potentially lucrative and disruptive scenario facing the electric power industry.

Among the themes:

How much additional generation needs to be built to serve data center loads — or is this more of transmission issue?

It is both, said Tom Falcone, president of the Large Public Power Council. There also are the secondary issues of supply chain and workforce adequacy, permitting and retirement of existing generation.

After two decades of flat demand, unprecedented growth is projected, said Clinton Vince, head of Dentons’ U.S. Energy Practice. Further, the 24/7 nature of this demand also is unprecedented, he said.

Jeff Weiss, executive chairman of Distributed Sun and truCurrent, said the 20th-century grid that exists is not up to the task: “Electricity scarcity is upon us, and this is the new world for industrials, for data centers, for consumers, where electricity is not abundant and we need to manage sources of power.” Fortunately, he added, battery storage is bridging some of the gap.

Speed is the overriding issue, said Derek Bentley, a partner at Solomon Partners, and trends are not favorable. GE Vernova needs a five-year lead time to equip a new combined-cycle gas plant that then takes a couple more years to build, while renewables are intermittent and the target of policy changes. “But with the data centers, you can generally build a data center in 12 to 18 months.”

Karen Ornelas, director of large load program management at Pacific Gas & Electric, said PG&E has started a cluster process for new load requests, which has reduced the duration and cost of engineering studies.

Tom Wilson, principal technical executive at EPRI, said demand flexibility will help ease the crunch that is developing. EPRI’s DCFlex initiative has involved more than 50 entities in multiple sectors to demonstrate ways data centers can moderate that 24/7 demand.

Balancing Act

How do you balance the sharp increase in new load with the imperatives of affordability and reliability? How do you balance the needs of new data centers with those of existing residential and industrial customers?

There is a lot of uncertainty, Falcone said, “and so what you see is a lot of reforms happening at the state level and with individual utilities to better understand and also get some financial commitments that are longer-term.”

Weiss said the nation is trying to grow in the 21st century using a 20th-century utility system, a prescription for failure, and “the regulatory construct puts a lot of lethargy” in moving forward from that. “Everything we do takes 10 years or more. We need to figure out how to do everything in two years … and it’s critical to our economy that we do that.”

That’s why so many behind-the-meter partnerships are being formed, Bentley said. “Unfortunately, there isn’t just a silver bullet solution right now, and so it does require a lot of things, all coming together, a lot of constituents working together to solve the problem.”

Bud Albright, senior energy adviser at the National AI Association, reminded listeners that policy does not exist in a vacuum: “We need to get in front of the public at a grassroots level, to educate them if you will, to the benefits of bringing new power online wherever it is. As we all know, there’s huge pushback when data centers come in, the public saying, ‘Don’t take our power, don’t take our power. It’s going to drive our costs up.’”

Trump Card

President Donald Trump is pushing through significant policy changes in the energy sector. What is he getting right, and what does he need to improve?

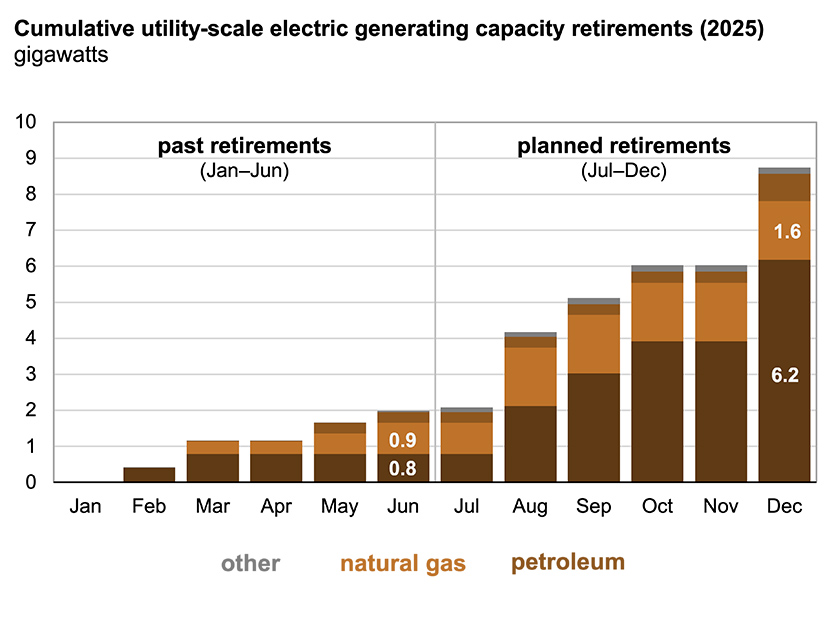

Vince praised Trump’s moves on nuclear power, battery storage and delayed fossil retirements but added: “I think the discontinuation of credits and other limitations on the solar and wind industry is unfortunate.”

The president has correctly framed the issue, which is the need for a review of existing processes and significant changes, Falcone said.

Redland Energy Group Principal John Howes said: “I think the president has done some very good things. For example, he’s done a lot to eliminate some of the bias against fossil fuels which existed in the last administration.” More attention must be paid to permitting reform, he said, as well as to the foundational components of the system, such as transformers, and to its human component, through workforce development.

Disruptive Presence

If hyperscalers can move more nimbly and set up behind-the-meter generation more quickly, do they become a threat to utilities?

If someone wants to cut the cord and truly be off the grid, they can order the equipment and install it, Falcone said, and maybe reach the finish line more quickly. But otherwise, they need to operate within the same construct as everyone else attached to the grid.

Vince said some utilities are working well with Big Tech and finding solutions. But many are not, and capitalized hyperscalers are proceeding without them, taking an entrepreneurial approach. “The slower utilities, I think, will be disadvantaged tremendously,” he said.

It need not be mutually exclusive, Bentley said — a data center that builds its own generation may not remain permanently or entirely behind the meter or off the grid. “We’re seeing a lot of unique and tailored solutions … a lot of innovative structures.”

Wilson said flexibility and adaptability such as demand response or onsite storage will help: “Agility is not just being able to buy equipment faster, but it’s being able to be an asset to the grid, as opposed to a passive load.”