WASHINGTON — The growing number of data centers offers a major growth opportunity for demand response, as it can help get the energy-hungry facilities online quicker than new generation, executives and data center experts said at CPower Energy’s GridFuture 2025 conference Aug. 6.

On top of that, renewables are growing, and their intermittency needs to be balanced, CPower CEO Michael Smith said at the event, held at the Omni Shoreham Hotel.

“We’ve dispatched more than we ever have this year,” he said. “So, all of these things are conspiring to create a further need for flexible load on the system.”

It takes a couple of years to build utility-scale solar and 15 years to build nuclear, he said. That does not factor how hard it is to get through the interconnection queues, or the relatively low forward prices in the markets compared to new-build costs that could rise further with the imposition of tariffs.

Duke University has shown that demand response could help unlock new data centers by making more efficient use of the existing grid, Smith said. (See U.S. Grid Has Flexible ‘Headroom’ for Data Center Demand Growth.)

Policymakers are starting to pay attention to that fact, with Senate Bill 6 in Texas requiring new loads at 75 MW or above to provide DR, ENP Consultants Director Jim McDonald said.

“You’re going to see … a new version of Senate Bill 6” everywhere, McDonald said. “When AEP came out with their data center-only tariff a year and a half ago, that was a novel idea.”

Many utilities now have adopted similar rules to AEP’s, which require more upfront deposits to secure a place on the grid. The same week as the conference, Google announced deals with AEP’s Indiana Michigan Power and the Tennessee Valley Authority to reduce power at its data centers when the grid is stressed in their territories. (See related story, Google Strikes Demand Response Deals with I&M, TVA.)

Training artificial intelligence models has been driving demand growth from the sector, and while that is energy intensive, once those models are trained, they are going to be put to work, which will use more power, said Morgan Scott, vice president of global partnerships and outreach for the Electric Power Research Institute.

“As we become more mature in the way that we use AI, it will continue to use more energy,” Scott said. “Will we find efficiencies? Yes. Are these numbers wrong? Yes. But the point is, they are directionally correct and give you conceptually an understanding that this is going to continue to grow because of the way that we are going to use AI and what we are asking these models to do.”

The hardware side also is changing quickly, with the lifespans of the equipment in data centers getting shorter and shorter. Microchips degrade in one to three years now and innovations are rolling quickly, she added.

“We’re seeing massive jumps in terms of what that electricity draw is, and so you can see we actually have a forecast of 1.2 MW per rack in a data center because of those changes within Nvidia chips,” Scott said.

The business opportunity for CPower and the DR industry in general is huge when it comes to the growing demand from AI, Smith said in an interview after the event.

“Those activities can stress the grid because they can come on fast and they can consume a lot of electricity very quickly,” Smith said. “So, that’s exactly what we do. We’re that shock absorber that monetizes or optimizes the value of the flexibility that’s inherent in those machines.”

CPower and other DR companies are able to provide them a channel to monetize the flexibility that is possible in their operations, Smith said.

Data centers can offer flexible load either by curtailing their operations, including by shifting them to other sites, or using on-site resources such as backup generators or, as Duke explored in its study, batteries.

“We give the market operator access to those assets, and the market operator then can dispatch effectively those assets when needed,” Smith said. “And it really is a dispatch protocol. … A market operator can and should be able to dispatch a 500-MW peaking plant or a 500-MW data center equally.”

AI Opportunities and Risks

CPower is looking into AI to help improve its operations. Smith said his sales team uses it to take notes in meetings, but eventually it should help with the software the company uses to manage aggregations of DR customers.

“It will help that software make better decisions about where to put various customer assets, in what programs [and] at what times,” Smith said. “We do develop our own software. We have to be pretty cognizant of the tools that are available to us and use them appropriately. I’m not super comfortable just turning AI loose for the sake of turning AI loose, but I think our IT organization has done a really nice job of allowing AI to be used in the organization.”

While the demand growth from AI and other sources presents opportunities for the entire power industry, it is not without its risks, CPower Chief Legal and Regulatory Officer Ken Schisler said in a separate interview.

“If we’re not careful, what could be voluntary DR participation becomes power rationing, and that’s going to be rejected by the public,” Schisler said.

Conscripting demand flexibility like in Texas Senate Bill 6 could prove politically unsustainable as well, he said.

“People are going to want to see the transmission built or the power stations built so that they can use power when and where they want it, and if they have flexibility, they want to be able to make it available to the grid on their terms, rather than have it conscripted and rationed for them,” Schisler said. “So … unless you have those flexibility opportunities widely available, you’re left with no choice but to sort of simply ration power.”

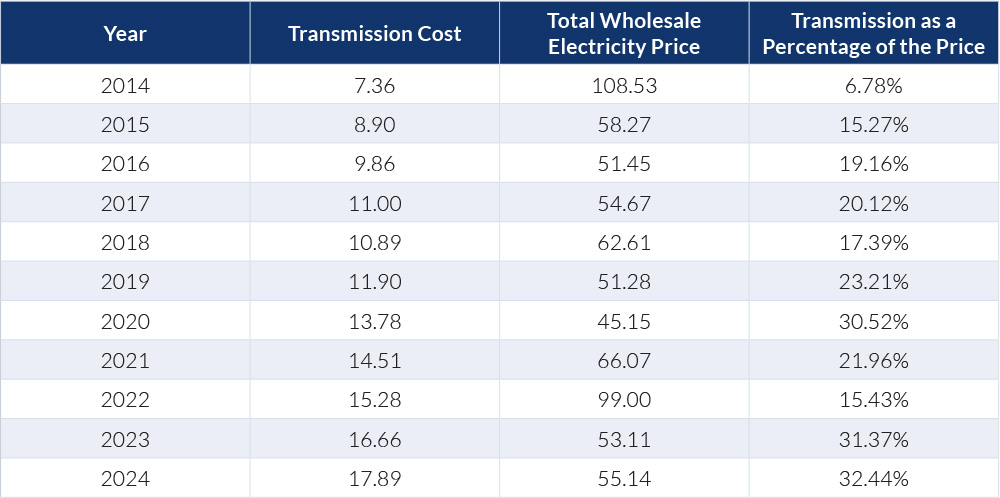

Rising prices have led to political pushback, with states in PJM looking for reforms to cushion their consumers. Schisler said he is familiar with that dynamic from his time on the Maryland Public Service Commission. When the state restructured, it placed temporary caps on the price of electricity. Some utilities’ caps expired in 2004 — just before natural gas prices spiked in response to two historic hurricanes, leading to much higher bills for customers.

“It happened right before Katrina and Rita” in 2005, Schisler said. “You wouldn’t want to be me back in those times, and we’re in one of those phases now.”

States have been updating their policies and working to get reforms through at PJM in response to the situation, but one area Schisler said could help is improving access to data from customers to help enroll even residential customers into DR to save them money.

Data access varies by state. Schisler said ERCOT’s market, wholly within Texas, is one of the best examples of making it easy and New York is working on reforms to do the same thing. But in multistate RTOs like PJM, it has proven much more difficult.

“I can go anywhere in the world, and I have a safe, secure banking system that I can get money out of an ATM, check my balance, etc., and know that that system is secure,” Schisler said. “But we’re still at a place where, at scale, interacting with utilities to get data is still a patchwork.”

One way some companies have gotten around this is to install their own meters so they can help customers manage their loads, but that is economically wasteful, Schisler argued. The issue for data access has been around for years; President Barack Obama tried to address it with the Green Button Initiative, which Schisler called “an anti-standard.”

“We’re still acquiring data through lots of different channels now; Green Button didn’t make that go away,” he added. “The other challenge with it is it’s largely an issue that is under the domain of state commissioners, yet the [reason] for accessing this data is for participation in wholesale markets, and we haven’t bridged that need with state regulators and with utilities.”