Until now, a carbon-free, load-following electric supply resource has been elusive. That may be about to change because of a resource that sits literally right below our feet — even if it is a mile or more down. That supply resource is the earth’s heat, which radiates continuously from the earth’s core, and entrepreneurs are quickly figuring out how to tap it.

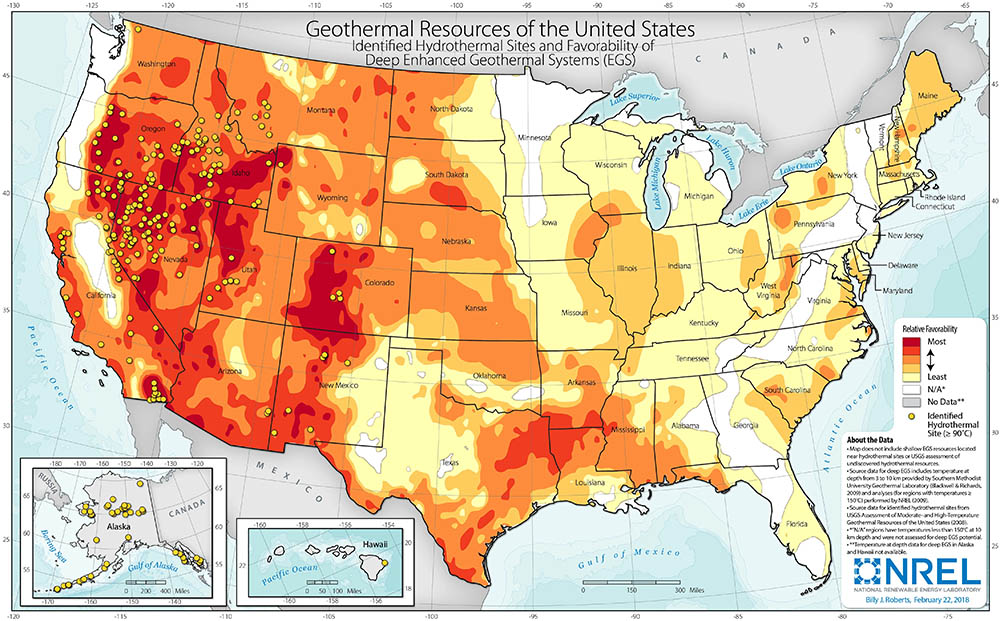

Developers have been accessing traditional geothermal energy resources for decades in those limited areas of the world where hydrothermal resources exist in the form of hot springs, geysers, volcanoes and fumaroles. These areas typically are near tectonic plate boundaries. In this country, 93% of the 3,700 MW of installed capacity is located in these more geologically active areas of California and Nevada. In recent years, though, development of domestic hydrothermal resources has stagnated.

Fortunately, a much larger geothermal resource exists that is more geographically widespread, and it doesn’t require the presence of existing underground water. Developers are tapping into this unconventional geothermal asset by using specialized equipment to drill holes miles deep into hot, hard rock — often granite.

Using techniques developed in the hydrocarbon fracking industry, specialized technicians drill at depth, then rotate the drills 90 degrees and guide them laterally to develop horizontal boreholes in the hot zones that often exceed 300 degrees Fahrenheit. Instead of relying on existing underground water resources, developers bring their own working fluids, typically water but also high-pressure supercritical carbon dioxide (neither a gas nor a liquid). These working fluids are circulated deep underground to harvest the rock’s ambient heat and bring it back to the surface, where it creates steam to spin turbines and generate power.

Drilling for Heat, not Hydrocarbons

This new geothermal industry already is branching off into multiple approaches, some of which may work better than others based upon local conditions. Today, the two main approaches are called enhanced and advanced geothermal.

Enhanced geothermal: The enhanced geothermal companies typically drill parallel wells and then frack the rock between the wells using high-pressure water. This creates fissures in the rock and establishes permeability and connectivity between two wells. An injection well introduces water into the system, which heats up when it contacts the broad surface areas in the broken rock. The second withdrawal well draws the heated water back to the surface for electricity generation.

Just as with hydrocarbon fracking, developers can punch multiple wells into the earth from a single pad, minimizing drilling time and surface area impacts. Fiber optic cables collect data relating to temperatures and the flow of the working fluids that capture and “mine” the heat from the rock. The trick is to optimize the flow of fluids to capture the maximum amount of heat extracted to the surface.

Advanced geothermal: With advanced geothermal development, some operators drill vertically and then horizontally, but rather than fracking the rock, they install a lining in the hole to create closed-loop circuits, essentially developing underground inverse radiators. Others use a pipe-within-a-pipe system, sending water down in one pipe and withdrawing it through the other. In either case, a finite quantity of working fluid — either water or supercritical CO2 — is injected into the closed system, heated by the surrounding rock, and then brought back to the surface. The use of supercritical carbon dioxide requires special turbines, but because it boils and creates high-pressure steam at lower temperatures, it can further enhance output.

The first commercial contracts point the way: Within the past year, leaders in this nascent industry have inked the first meaningful deals. Pathbreaker Fervo Energy signed its first 3-MW proof-of-concept contract with Google in late 2023. It then turned its attention to developing a far larger effort in Cape Station, Utah, and has signed contracts with Shell Energy, Clean Power Alliance and Southern California Edison, with initial deliveries from its 500-MW facility beginning next year.

Fervo also recently received regulatory approval for a contract to deliver 115 MW of electricity to Google through Nevada utility NV Energy. Other geothermal players also are inking agreements. Last August, Sage Geosystems announced a deal with Meta for 150 MW of geothermal energy in Texas, to be commissioned by 2027. In June, XGS Energy and Meta hailed an agreement for 150 MW of geothermal to be developed in New Mexico, with an online date of 2030, and in May, Exceed Geoenergy announced a 110-MW contract with Presidio Municipal Development District, with the first 9.9 MW to be online in late 2026.

Technological advancements: Just as the fracking industry saw rapid technological development and improvements resulting in lower costs, the new geothermal players also are pushing the envelope as they drill deeper into challenging heat and hard rock environments. They use tools and practices adopted from conventional drilling and fracking and adapt those to their specific industry. These include specialized polycrystalline diamond drill-bits, specialized lubricants and additions to the drilling mud that keep the well cool enough for the equipment to operate.

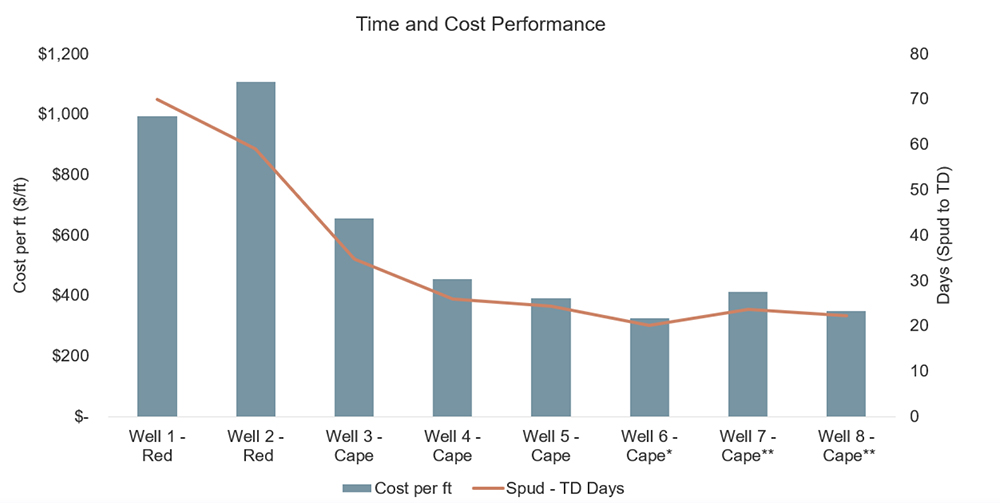

A recent paper evaluating drilling speeds and costs demonstrated significant progress — in terms of speed, required number of drill bits and related costs — with each new well drilled. In the example cited, Fervo was able to demonstrate a 60% improvement in drilling speeds over just eight wells.

Faster Wells for Less Money

Multiple players, with a growing pot of money: There are more than a dozen geothermal startups in the U.S., with Texas seeing the greatest concentration. Together, they have been funded with more than $2 billion (Fervo just raised an additional $206 million for project financing in June).

Many companies are far enough along in their efforts that 11 of them have been pre-qualified by the U.S. Department of Defense for projects on military bases (and seven pilots reportedly are in the works). Most are adapting existing oil and gas technology, but startup Quaise is using a different approach. It emulates others by drilling to initial depths using conventional technology. However, it then plans to go far deeper than its competitors — as far as 12.5 miles down to access heat over 900 F — and to achieve this goal, it is testing high-powered millimeter waves that vaporize holes in the rock.

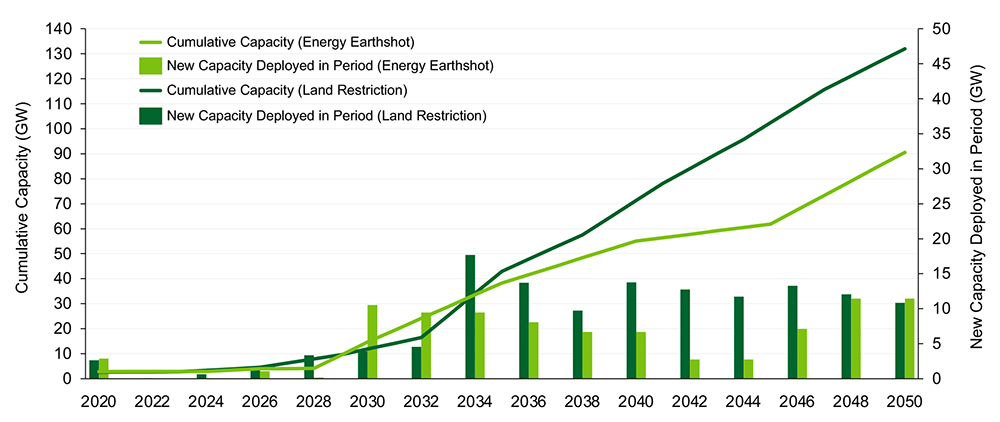

Size of potential resource: Studies suggest the geothermal resource is enormous. A June 2025 study looking at New Mexico estimates as much as 163 GW of potential geothermal production, 15 times the state’s installed capacity. At the national level, a 2024 Department of Energy Lift-off study suggested a potential 90 to 130 GW of installed capacity over the next 25 years.

The Potential is There, but can we Cost-effectively Access it?

That number would represent a fraction of the 7,000 GW of national potential at three miles deep, and 70,000 GW accessible at all depths. There’s one inherent challenge here, though: The geology of the U.S. clearly favors the West, where drillers can access heat at far shallower depths. Because going deeper has been prohibitively expensive and time consuming until now, the Eastern U.S. has been largely excluded from consideration.

Drill West, Young Man!

That may be changing, though, as evidence is beginning to suggest that perhaps these deeper depths are more easily attainable. Fervo announced in June that it had drilled a new well to a depth of 15,765 feet (75 feet shy of three miles!) in only 16 days, accessing temperatures in the range of 520 F. Furthermore, it was able to drill laterally through the hard rock at that depth at an impressive rate of over 300 feet per hour.

Hype or real reason for hope? While it’s still too early to tell, and early capital certainly will be deployed where drilling is easier and more cost-effective, we may see an industry expansion to the east in the visible future. For the emerging unconventional geothermal industry, the theoretical potential is there and the first facts on (and in) the ground are promising.

The industry already has viable and tested technology, successes, financing and the first commercial contracts in hand. It also may have continued government support in the form of continued tax credits and a relatively easy permitting process for projects on federal lands. We will know a lot more about just how real this industry is in just a few short years.

Around the Corner columnist Peter Kelly-Detwiler of NorthBridge Energy Partners is an industry expert in the complex interaction between power markets and evolving technologies on both sides of the meter.